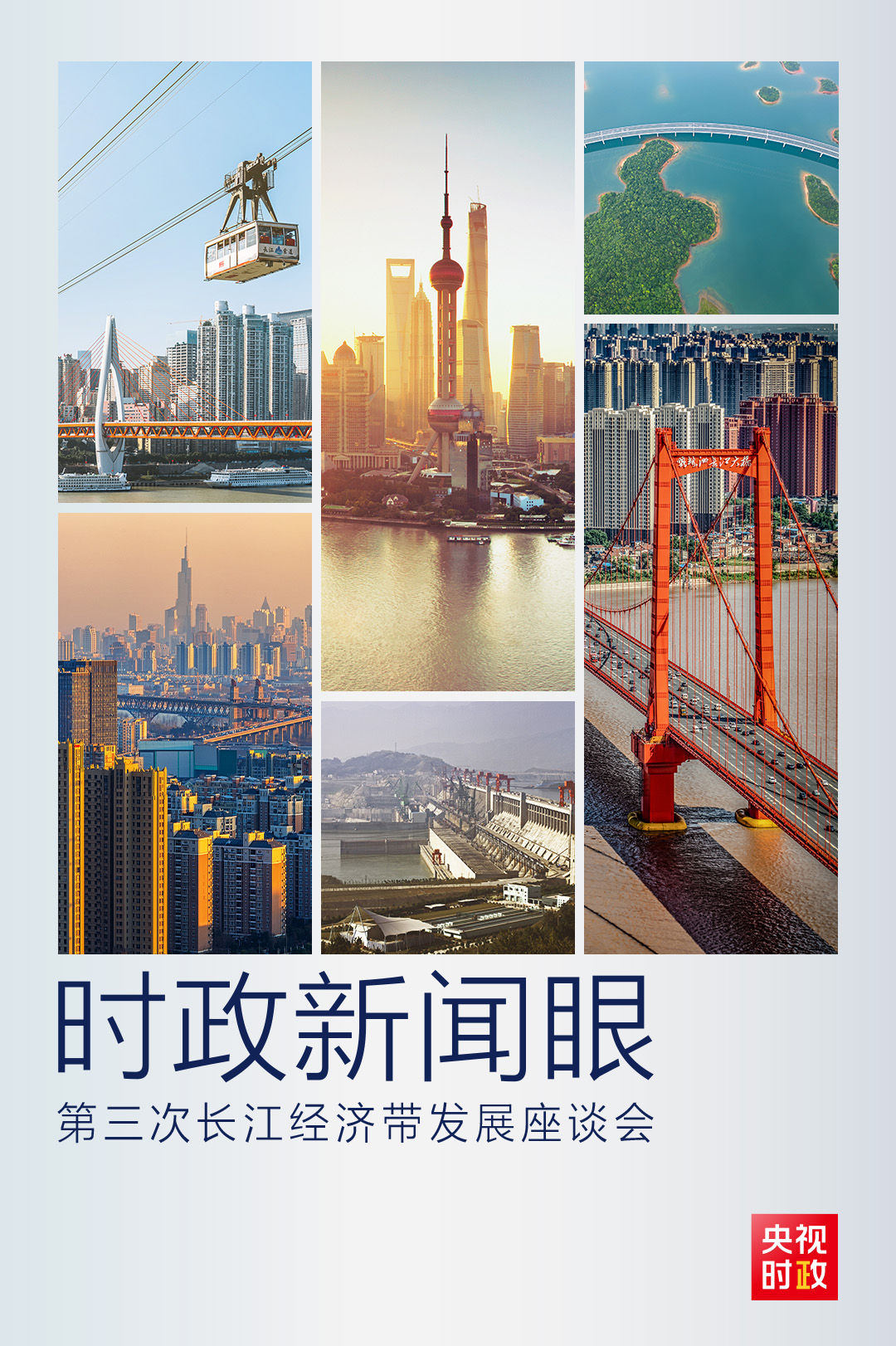

On November 14th, General Secretary of the Supreme Leader specially held a symposium in Nanjing — — Symposium on comprehensively promoting the development of the Yangtze River Economic Belt. This is the third symposium on the development of the Yangtze River Economic Belt and the first symposium after the Fifth Plenary Session of the 19th Central Committee. Main battlefield, aorta and main force … … The general secretary has given a new mission to the development of the Yangtze River Economic Belt.

Three symposiums:

From "Push", "Deep Push" to "All-round Push"

The three symposiums on the development of the Yangtze River Economic Belt, which were personally presided over by the General Secretary of the Supreme Leader, were held in three important years, namely, 2016, 2018 and 2020, and were held in Chongqing, Wuhan and Nanjing in the upper, middle and lower reaches of the Yangtze River. The topics have also evolved from "promotion" and "in-depth promotion" to "comprehensive promotion".

△ Overlooking the Nanjing section of the Yangtze River from Nanjing Mufu Mountain

On January 5, 2016, the symposium on promoting the development of the Yangtze River Economic Belt was held by the top leaders during their investigation in Chongqing. At the meeting, the general secretary comprehensively and profoundly expounded the great significance, promotion ideas and key tasks of the development strategy of the Yangtze River Economic Belt, and clearly put forward "Strive for great protection, not great development.”。

△ Volunteers in Yongchuan District of Chongqing pick up garbage in Zhutuo section of the Yangtze River.

On April 26, 2018, the Supreme Leader hosted a symposium in Wuhan to further promote the development of the Yangtze River Economic Belt. In order to have a good symposium, the General Secretary went to Hubei and Hunan to learn about the implementation of the development strategy of the Yangtze River Economic Belt. At the meeting, the general secretary focused on five relationships that need to be correctly grasped to promote the development of the Yangtze River Economic Belt.

This year’s symposium was specially hosted by the supreme leader after his inspection in Jiangsu. At the meeting, the general secretary summed up the achievements in the past five years: the ecological environment protection in the Yangtze River Economic Belt has taken place.Turning change, economic and social development.Historic achievements. Facing the future, the General Secretary pointed out that the Yangtze River Economic Belt has a prominent ecological position and great development potential, and should play an important role in practicing new development concepts, building a new development pattern and promoting high-quality development.

These three symposiums, spanning five years, have become an important milestone in implementing the major national strategy of developing the Yangtze River Economic Belt.

△ Jiangsu Taicang Container Terminal

Main battlefield: ecological priority and green development

At the symposium in January 2016, the supreme leader pointed out that promoting the development of the Yangtze River Economic BeltWe must adhere to the strategic orientation of ecological priority and green development. At the symposium in April 2018, the general secretary made such an explanation: "It is the premise to focus on the protection of the ecological environment and ecological priority; Not engaging in large-scale development and green development is about economic development, not the result; Grasp the great protection together, do not engage in great development, focus on the current and strategic methods; Ecological priority and green development emphasize the future and direction path, which are dialectical unity with each other. "

△ Hukou County, Jiangxi Province was named after Poyang Lake entered the Yangtze River estuary, and the local government built the "most beautiful coastline" with the help of the "Green Shore" project.

At this year’s symposium, the supreme leader first emphasized that it is necessary to strengthen the protection and restoration of the ecological environment system and put the restoration of the Yangtze River ecological environment in an overwhelming position. The general secretary pointed out that it is necessary to proceed from the integrity of the ecosystem and the systematicness of the river basin, trace the source and treat it systematically to prevent headaches and pains. He also mentioned in particular that,Maintain the ecological authenticity and integrity of the Yangtze River..

Not long ago, the "14th Five-Year Plan" proposed by the Fifth Plenary Session of the 19th Central Committee emphasized the need to promote green development and the harmonious coexistence between man and nature. At the forum on November 14th, the Supreme Leader pointed out that the Yangtze River Economic Belt should strive to build a harmonious coexistence between man and nature.Green development demonstration zone. The planning proposal proposes to establish a mechanism to realize the value of ecological products. At the symposium, the general secretary stressed that it is necessary to speed up the establishment of a mechanism for realizing the value of ecological products, so that the protection and restoration of the ecological environment can get a reasonable return and the ecological environment can be destroyed at a corresponding price.

△ After the implementation of the "No Fishing in the Yangtze River", Dongxing District, Neijiang, Sichuan Province concentrated on dismantling fishing boats, and all 352 fishermen landed and switched jobs.

Since the 18th National Congress of the Communist Party of China, General Secretary of the Supreme Leader has traveled to 11 provinces and cities covered by the Yangtze River Economic Belt. Since this year alone, he has visited Yunnan, Hubei, Zhejiang, Anhui, Hunan and Jiangsu provinces, and hosted a symposium in Hefei to promote the integrated development of the Yangtze River Delta. Ecological priority and green development are always emphasized by the General Secretary. At this symposium on November 14, the general secretary clearly stated that it is necessary toMake the Yangtze River Economic Belt the main battlefield of China’s ecological priority and green development..

Aorta: Smooth domestic and international double circulation

The "Fourteenth Five-Year Plan" proposes to accelerate the construction of a new development pattern with the domestic big cycle as the main body and the domestic and international double cycles promoting each other. This is a strategic choice to keep pace with the times and improve the level of China’s economic development, as well as to shape China’s new advantages in international economic cooperation and competition.

△ At the beginning of November, the Three Gorges Project, the "national heavyweight", completed the overall completion acceptance. This is the Three Gorges Dam in Yichang, Hubei Province.

The Yangtze River Economic Belt can be called the "golden waterway" of China. General Secretary of the Supreme Leader once pointed out that the Yangtze River Economic Belt is the economic center and vitality of our country. In building a new development pattern, the Yangtze River Economic Belt has both unique advantages and unshirkable mission.

At the symposium on November 14, the Supreme Leader stressed that it is necessary toAdhere to the idea of a national chess gameTo define the orientation of self-development in the overall situation of national development and explore effective ways to promote the smooth domestic circulation. The general secretary clearly pointed out that in order to promote the coordinated development of the upper, middle and lower reaches, it is necessary to guide the capital, technology and labor-intensive industries in the downstream areas to transfer to the upper and middle reaches in an orderly manner and retain key links in the industrial chain. He also stressed the need to build a unified, open and orderly transportation market.

△ Lianyungang, Jiangsu Province is the intersection city of "Belt and Road", which is a domestic car and wind blade waiting for export.

The Yangtze River Economic Belt is the main intersection of the Belt and Road Initiative in China. At the forum, the Supreme Leader emphasized that the provinces and cities along the Yangtze River should find their respective positions in the new development pattern of domestic and international double circulation promoting each other and take the initiative to open their markets to the world. He proposed that it is necessary to co-ordinate the opening up of coastal areas along the Yangtze River and inland areas, accelerate the cultivation of more inland open highlands, improve the level of opening up along the border, and achieve high-quality introduction and high-level going out.

△ On the same day, the General Secretary of the Supreme Leader also focused on protecting and inheriting the Yangtze River culture. This is the giant Buddha in Leshan, Sichuan.

Main Force: Leading High-quality Economic Development

In April 2018, the General Secretary of the Supreme Leader proposed at the symposium to further promote the development of the Yangtze River Economic Belt that the Yangtze River Economic Belt should become a new force leading the high-quality development of China’s economy. At this year’s symposium,The "new force" has been upgraded to the "main force".

The "Fourteenth Five-Year Plan" proposes that the economic and social development during the "Fourteenth Five-Year Plan" period shouldWith the theme of promoting high-quality developmentThis is a scientific judgment based on the changes in China’s development stage, development environment and development conditions. The Yangtze River Economic Belt, which accounts for half of the country’s population and total economic output, is undoubtedly an important engine for China’s high-quality economic development.

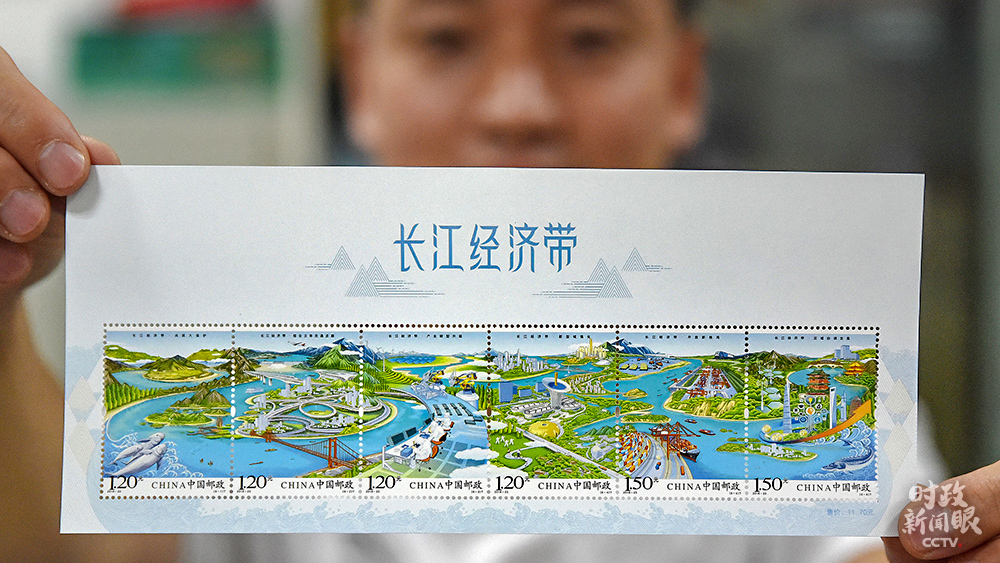

△ This is a special stamp of the Yangtze River Economic Belt issued by China Post in August 2018.

At the forum on November 14th, the Supreme Leader pointed out that the Yangtze River Economic Belt shouldAccelerate the upgrading of industrial base and the modernization of industrial chain. The general secretary stressed that we should be brave in innovation, persist in focusing on the real economy, and comprehensively shape new advantages of innovation-driven development.

△ Chengdu-Chongqing urban agglomeration is one of the three growth poles of the Yangtze River Economic Belt. On October 16th this year, the Political Bureau of the Central Committee deliberated the Outline of the Construction Plan for the Twin Cities Economic Circle in Chengdu-Chongqing Region, demanding that the "Tale of Two Cities" be sung well.

The general secretary proposed to step up the layout of a number of major innovation platforms, accelerate the breakthrough of a number of key core technologies, and strengthen the support capabilities of key links, key fields and key products; It is necessary to build an advanced manufacturing cluster with international competitiveness and build an industrial chain supply chain that is self-controllable, safe and efficient and serves the whole country. These are all realized.High-quality development and high-quality lifeThe key move.

△ A new energy auto parts production line in Changzhou, Jiangsu

On August 19th this year, when the Supreme Leader inspected the ecological protection of the Yangtze River in Maanshan, Anhui Province, he said that it is necessary to enhance the awareness of caring for and protecting the Yangtze River and reproduce the scenic spot of "one river with clear water flowing eastward" as soon as possible. At the forum on November 14th, the General Secretary once again sent a message: We should maintain historical patience and strategic determination, draw a blueprint to the end, and work one after another to ensure that the clear water of a river will last for future generations and the people of Hui Ze.

This is the grand plan of the Yangtze River in the new era.

Producer: Shen Yong

The main author is Gong Xuehui and Yu Zhenyi.

Visual sense

Camera Team of News Center, Headquarters

Editor: Liu Huimin, yan hou, Cai Jingxian, Li Jin.

Editor Wang Jiyang

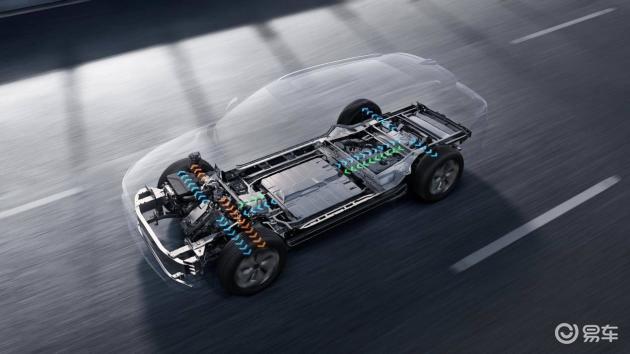

Byd Qin l

Byd Qin l Chinese DM-p edition

Chinese DM-p edition

Equation Leopard Leopard 8

Equation Leopard Leopard 8

Geely EM-P/EM-i

Geely EM-P/EM-i Xinlingke 09 EM-P

Xinlingke 09 EM-P Lingke 07 EM-P

Lingke 07 EM-P Lingke 08 EM-P

Lingke 08 EM-P Geely 7

Geely 7