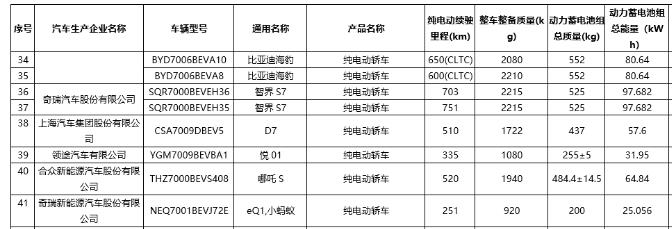

The small partners who are concerned about new energy vehicles must have learned a recent news: the Ministry of Industry and Information Technology issued a new announcement, announcing that a series of models will enjoy preferential policies for purchase tax reduction and exemption. In the model catalog, Xiaomi SU7,Seals and Zhijie S7, which are particularly popular recently, are listed!

On the one hand, these models have excellent performance, on the other hand, they will also bring real benefits to car owners in terms of purchase tax. So, how do you understand the impact of the New Deal on the new energy vehicle industry?

Judging from the nature, the preferential policy of purchase tax reduction is an important policy issued by the state to encourage the development of new energy vehicles and promote green travel. By reducing the purchase tax, the economic pressure on consumers to buy cars will be reduced, thus further promoting the prosperity and development of the new energy vehicle market.

The introduction of the purchase tax reduction and exemption policy further highlights the state’s attention and support for the new energy automobile industry. With the increasing awareness of global environmental protection and the rapid development of new energy vehicle technology, new energy vehicles will occupy a dominant position in traffic travel in the future.

At the same time, according to the data of China Automobile Association, in March 2024, the production and sales of new energy vehicles were 863,000 and 883,000 respectively, up by 28.1% and 35.3% year-on-year and 86.0% and 85.1% quarter-on-quarter. This is mainly due to the resumption of business operations after the Spring Festival, the large number of new cars coming on the market, and the new round of price reduction promotion in the auto market, which was encouraged by policies such as trade-in and trade-in. In March, the sales of new energy vehicles achieved significant growth on schedule, continuing the rapid growth momentum year-on-year. This time, many models covered in the new purchase tax reduction and exemption policy are actually hot models in previous months, and the intention of the state to guide the further development of new energy vehicles is very obvious.

Source: China Automobile Association

The implementation of the purchase tax reduction and exemption policy has brought tangible benefits to consumers and injected new vitality into the entire new energy vehicle market. As the "heart" of new energy vehicles, under the constant stimulation of the demand for new energy vehicles, the power battery sector will also usher in a good opportunity, and it can be forward-looking at present.

I prefer the battery ETF(SH561910) as the related target, and this one.ETFTracking the CSI battery theme index, it mainly invests in high-quality enterprises in the battery industry chain, including battery manufacturers and material suppliers. If funds are limited or there is not much time to learn more about many enterprises in the industry chain, I think investing in ETF one-click layout is a better choice.

Source: Shan Yu Qiu

关于作者