China Fund Journal, Taylor

Wang Jianlin is still selling.

Wang Jianlin continues to sell assets

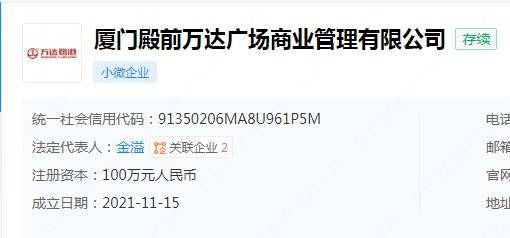

Data show that Xiamen Dianqian Wanda Plaza Commercial Management Co., Ltd. changed its shareholding on January 16, and the company’s shareholders were changed from the joint stock company of Zhuhai Wanda Commercial Management Group to Xiamen Jinliyang Real Estate Co., Ltd., and the legal representative was changed from Gao Qian to Jinyi.

The acquisition of Xiamen Jinliyang Real Estate Co., Ltd. was established on April 13, 2011. The legal representative is Wu Chengkun. Its business scope includes commercial circulation facilities and commercial building operation and management, leasing, and property management.

Previously, there have been shareholder changes in several Wanda plazas across the country.

On January 8, Foshan Shunde Wanda Plaza Business Management Co., Ltd. changed its shareholding. Dalian Wanda Commercial Management Group’s joint stock company withdrew from the company’s shareholders, and Foshan Yueshang Maojing Enterprise Management Co., Ltd. held 100% of the shares. After equity penetration, Foshan Yueshang Maojing Enterprise Management Co., Ltd. was ultimately controlled by Meizhi Service Group Co., Ltd., a subsidiary of Midea Real Estate.

Midea Real Estate responded that the assets of Foshan Shunde Wanda Plaza have always been held by companies in the United States. Previously, Wanda Commercial Management was entrusted to conduct light asset management and use the Wanda brand. Wanda did not hold the assets of Foshan Shunde Wanda Plaza. This transaction does not involve the transfer of assets of the square, but only the equity of the commercial management company of the square. The subsequent business operations of Foshan Shunde Wanda Plaza will be handled by Midea Real Estate.

On December 27, 2023, it was reported that the equity change had recently occurred in Shanghai Jinshan Wanda Investment Plaza. Dalian Wanda Commercial Management Group joint stock company withdrew from the list of shareholders of the company. The new shareholder was Suzhou Lianshang No. 2 Commercial Management Co., Ltd., and the legal representative of the company was changed from Gao Qian to Guan Zhaoyu.

On December 25 and 26, 2023, Dalian Wanda Commercial Management withdrew from the list of shareholders of Taicang Wanda Plaza Investment Co., Ltd. and Huzhou Wanda Investment Co., Ltd. The two companies added Suzhou Lianshang No. 3 Commercial Management Co., Ltd. and Suzhou Lianshang Wuhao Commercial Management Co., Ltd. as full shareholders respectively.

On December 29, 2023, the equity of Guangzhou Luogang Wanda Plaza Co., Ltd. changed, and the joint stock company of Dalian Wanda Commercial Management Group withdrew from the company’s shareholders, and Suzhou Lianshangsi Commercial Management Co., Ltd. held 100% of the shares.

According to statistics, since 2023, Wanda has gradually transferred 10 Wanda plazas. According to industry sources, according to Wang Jianlin’s previous plan, Wanda Group will sell some of its Wanda plazas nationwide in exchange for liquidity.

Wanda has sold its assets several times

In order to ease the liquidity crisis, assets such as Wanda Hotels and Wanda Film have also been sold recently.

On December 12, 2023, Wanda Film announced that the company indirectly controlled Wanda Culture Group and its wholly-owned subsidiary Beijing Hengrun, the actual controller Wang Jianlin and Shanghai Ruyi Investment Management Co., Ltd. signed the Equity Transfer Agreement, intending to transfer 51% of the company’s controlling shareholder Wanda Investment to Ruyi Investment, with a total transfer price of 2.155 billion yuan.

On December 22, the ownership of Shanghai Wanda Hotel Investment Co., Ltd., a subsidiary of Dalian Wanda Commercial Management, changed from Dalian Wanda Commercial Management to Beijing Yinglang Commercial Management Co., Ltd.

On December 12, 2023, the Wanda gambling crisis was lifted. PAG and Dalian Wanda Commercial Management Group jointly announced the signing of a new investment agreement. PAG will work with other investors to reinvest in Zhuhai Wanda Commercial Management after its investment redemption period expires in 2021 and is redeemed by Dalian Wanda Commercial Management Group. Existing investors invested about 38 billion RMB in Zhuhai Wanda Commercial Management in August 2021, of which PAG’s investment is about 2.80 billion US dollars (about 18 billion RMB). Existing investors enjoy redemption rights in the original investment arrangement.

According to the new agreement, Dalian Wanda Commercial Management holds 40% of the shares, making it the single largest shareholder. Several existing and new investors such as Pacific Alliance will participate in the investment, with a total stake of 60%. Wanda will work with Pacific Alliance and other important shareholders to further optimize the corporate governance of the company, maintain the stability of the management team, and jointly support the long-term development of the company.

The market believes that the signing of the new agreement may mean that Wanda’s huge share repurchase crisis has been temporarily lifted. However, comparing the equity data, it will be found that the shareholding ratio of Dalian Wanda Commercial Management Group in Zhuhai Wanda Commercial Management has dropped significantly, and it has "lost weight" a lot.

Step on thunder! 120 million yuan, only 4.37 million! Continue to slide to see the next one

Suddenly! Wang Jianlin, sold again, China Fund News, light touch to read the original text

China Fund Report Swipe up to see the next one

Original title: "Suddenly! Wang Jianlin, sold again"

Read the original text

关于作者