In 2024, the 60th anniversary of the establishment of the Jiangqi Group. Over the past 60 years, from scratch, from small to large, from a single product to a business, from traveling all over China to becoming famous all over the world, Jiangqi Group has never stopped striving.

60 years of hard work, and a son has been committed to it. Jianghuai 1 Card has always adhered to it, which not only witnessed the struggle of Jianghuai Group, but also served as a solid backing for Jianghuai Group to promote the high-quality development of China’s automobile industry.

In April 1968, the first 2.5-ton truck was born, filling the gap in Anhui’s automobile industry.

Looking back on the active exploration of JAC Group over the past 60 years, especially the advancement of JAC 1 Card, it has not only left a strong impression on the commercial vehicle industry, but also tackled difficulties and controlled "new" in the new round of industrial revolution, and unswervingly promoted the revitalization of the national automobile industry, moving towards the goal of "China’s 1 Card, the world’s 1 Card".

Adhering to the "chassis spirit" for 60 years

Since the establishment of the factory in 1964, JAC Group has gone through a journey of hard work, which is also the growth path of Jianghuai 1Card. From the 1960s, when it built the first cargo light truck in Anhui Province, to the 1990s, when it independently innovated to create the trend of China’s light truck sedan, and then to build the world’s highest standard high-end and pure electric light truck production base during the 13th Five-Year Plan period, Jianghuai 1Card has always adhered to the "chassis spirit" and continuously achieved breakthroughs in manufacturing strength and product quality.

The achievements of Jianghuai 1 Card are obvious to all in the industry. As Xiang Xingchu, Secretary of the Party Committee, Chairperson and General Manager of Jianghuai Automobile Group Holding Company, said, the development of Jianghuai Automobile has always had a strong impact on the light vehicle industry.

60 years of hard work, Jianghuai 1 card embarked on a new journey. On January 30 this year, in the brand-new world-class light truck factory of JAC Group, the high-end and pure electric light truck production base of Jianghuai 1 card, after more than 6 years, ushered in the 700,000 car officially rolled off the production line.

This is the fruit of JAC Group not forgetting its original intention and promoting the high-quality development of the manufacturing industry. It is also the strength of Jianghuai 1Card to develop green intelligent manufacturing and continuously improve product quality. The 700,000 high-end pure electric light truck officially rolled off the production line, which is not only an important milestone for Jianghuai 1Card to move towards the era of new energy commercial vehicles, but also a landmark event for Jianghuai 1Card to attack the intelligent and new energy field of commercial vehicles.

Faced with the profound changes in the current global automotive industry, the wave of new energy and intelligent transformation is rushing. Jianghuai 1Card insists on technological leadership and builds the "Star Chain No. 1" technology brand, aiming to empower high-end smart trucks with better chassis.

It is reported that "Star Chain 1" is the first all-scenario high-tech brand in China’s commercial vehicle industry. It consists of four major technology platforms of "fuel, hybrid, pure electricity and hydrogen energy", and has four core technologies of "wisdom, efficiency, green and safety", aiming to meet the growing needs of the light logistics and transportation industry. The birth of the "Star Chain 1" technology brand not only marks the Jianghuai 1 card based on the "troika" strategy, promoting technological leap and product upgrading, empowering the green and low-carbon transformation and development of modern logistics, but also represents a major breakthrough in China’s light commercial vehicle industry, which will profoundly affect the future development direction and pattern of China’s commercial vehicles, and is expected to build a leading technological advantage for the global light commercial vehicle market.

Mastering the key technologies of the chassis, Jianghuai 1Card has realized the iterative upgrade of the first-generation chassis from the 1960s to the fourth-generation chassis today, establishing a strong competitive advantage in the core technology field of commercial vehicle chassis. In the face of a new round of technological revolution and the acceleration of industrial transformation, Jianghuai 1Card actively embraces change, accurately grasps market trends, and independently develops a new generation of modular platforms, which can be compatible with different body types, and can also be adapted to various power systems such as pure electric, fuel and hybrid power. With the blessing of the fourth-generation chassis, Jianghuai 1Card’s various models are very popular in the market, bringing higher value experience to millions of users.

Hot-selling in 132 countries and regions around the world

According to the latest sales data, in the first quarter of this year, the cumulative sales of light commercial vehicles in our country increased by 0.68% year-on-year. Jianghuai 1 Card sold 35,337 vehicles and increased by 20.3% year-on-year, far exceeding the industry average and leading the market.

Light commercial vehicles, as the core business segment of JAC Group, have continued to iterate and upgrade with the strength of "mastering the key technologies of the chassis", and have become the leading brand in the mid- to high-end light truck market in our country. In overseas markets, JAC 1Card insists on deeply cultivating the global high-end market, and its products are sold well in 132 countries and regions around the world, becoming the leading brand of light truck exports in China.

Taking Jianghuai 1 Card Shuai Ling as an example, thanks to the "five high-end benchmarks" empowered by high-end power, high-end intelligent manufacturing, high-end technology, high-end quality and high-end value, Jianghuai 1 Card Shuai Ling has outstanding market competitiveness and has won the trust and praise of global users. In addition, Jianghuai 1 Card Shuai Ling continues to promote technological innovation and product upgrades, launching models including Shuai Ling I, Shuai Ling II, Shuai Ling III, all-round trucks, Shuai Ling S series, etc., to meet the segmentation needs of urban logistics vehicles, and achieve a comprehensive improvement in product sales, market share, and user reputation in domestic and foreign markets.

According to statistics, Jianghuai 1 card Shuailing, as a leader in the export of high-end light trucks, has more than 600,000 global high-end users, not only won the favor of many Fortune 500 companies, but also successfully completed the service guarantee task of many major activities, whether it is word-of-mouth or brand influence, have achieved leapfrog development.

In order to better serve overseas users, Jianghuai Automobile has established overseas R & D centers in Japan and Italy, and has cooperated with many top strategic partners, including Italy’s Binfa, UK Lotus, Austria’s AVL, and Germany’s HOFER, to bring a more high-end and intelligent transportation experience to global users with a new platform modular design, five intelligent values, and ten leading technologies.

In the future, Jianghuai 1 Card will continue to deepen its overseas market, accelerate its globalization, and launch safer, more environmentally friendly, more energy-efficient, and smarter new energy commercial vehicles around the world, making the development path wider and brighter, and becoming a world-renowned "China Truck, World Brand".

Harness the "new" and promote Chinese brands to the world

In recent years, JAC 1 Card has continued to deeply integrate technological upgrades and product innovation, promoting the comprehensive advancement of commercial vehicles to new energy, intelligence, and networking, fully meeting the vehicle needs of different users, different markets, and different scenarios, and helping the highway logistics industry to reduce costs and increase efficiency.

In terms of new energy, new energy commercial vehicles are an important engine for Jianghuai 1Card to cultivate new productivity. Jianghuai 1Card adheres to the long-term concept, anchors the "Troika" strategy, and builds a new productivity base with the "Star Chain No. 1" technology brand. Oil-mixed electric models are fully developed, becoming the "main force" for the development of new productivity in the commercial vehicle industry.

In terms of intelligence, Jianghuai 1 Card is pioneering the development of intelligent driving technology, AMT, DHT, MMT and other transmissions to make driving more convenient; fusing functions such as adaptive cruise, lane keeping assistance, and automatic emergency braking, the industry has taken the lead in mass production of L2-level intelligent light trucks, and further created the world’s first L2 +-level intelligent light trucks; it has taken the lead in mass production of wire-controlled chassis core components such as wire-controlled braking, wire-controlled steering, automatic gear shifting, and electronic-controlled suspension, and L4-level unmanned trucks have begun demonstration operations; the latest intelligent technologies such as chassis anti-theft, lateral angle radar, remote vehicle control, and intelligent cockpit have been applied simultaneously, making driving more comfortable, convenient, and safe.

In terms of networking, the Jianghuai 1 card is equipped with the Smart Bell vehicle to everything 3.0 system, which integrates intelligent driving, intelligent services, and intelligent fleets to open the era of intelligent new energy trucks; reconstruct the underlying logic with user thinking, and build the Jianghuai card friends digital ecological platform with the full value chain of "car selection, car purchase, car use, car management, car maintenance" and "business circle, life circle, and ecosystem" as the core. Build a new interconnected ecosystem of "people, vehicles, and freight yards".

Technology is a paddle, products are a ship, and what drives it forward is the awe of the market and users that has been precipitated in the history of Jianghuai 1 Card’s car manufacturing. This awe is complementary to the "user thinking" that Jianghuai 1 Card has always adhered to. 60 years of driving "new", Jianghuai 1 Card has always adhered to technological innovation and product leadership, driven product innovation with technological upgrades, and unswervingly created high-end trucks with excellent chassis and leading intelligence, so as to revitalize the national automobile industry and promote Chinese automobile brands to the world.

(This version of the picture is provided by the company)

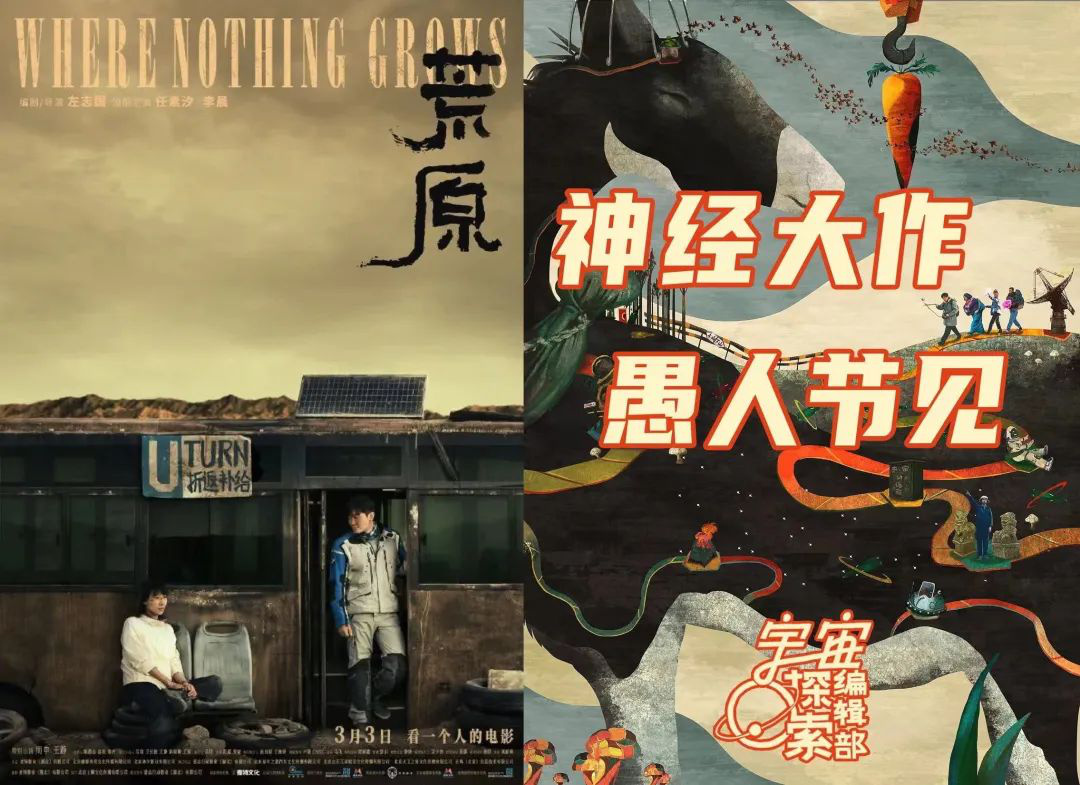

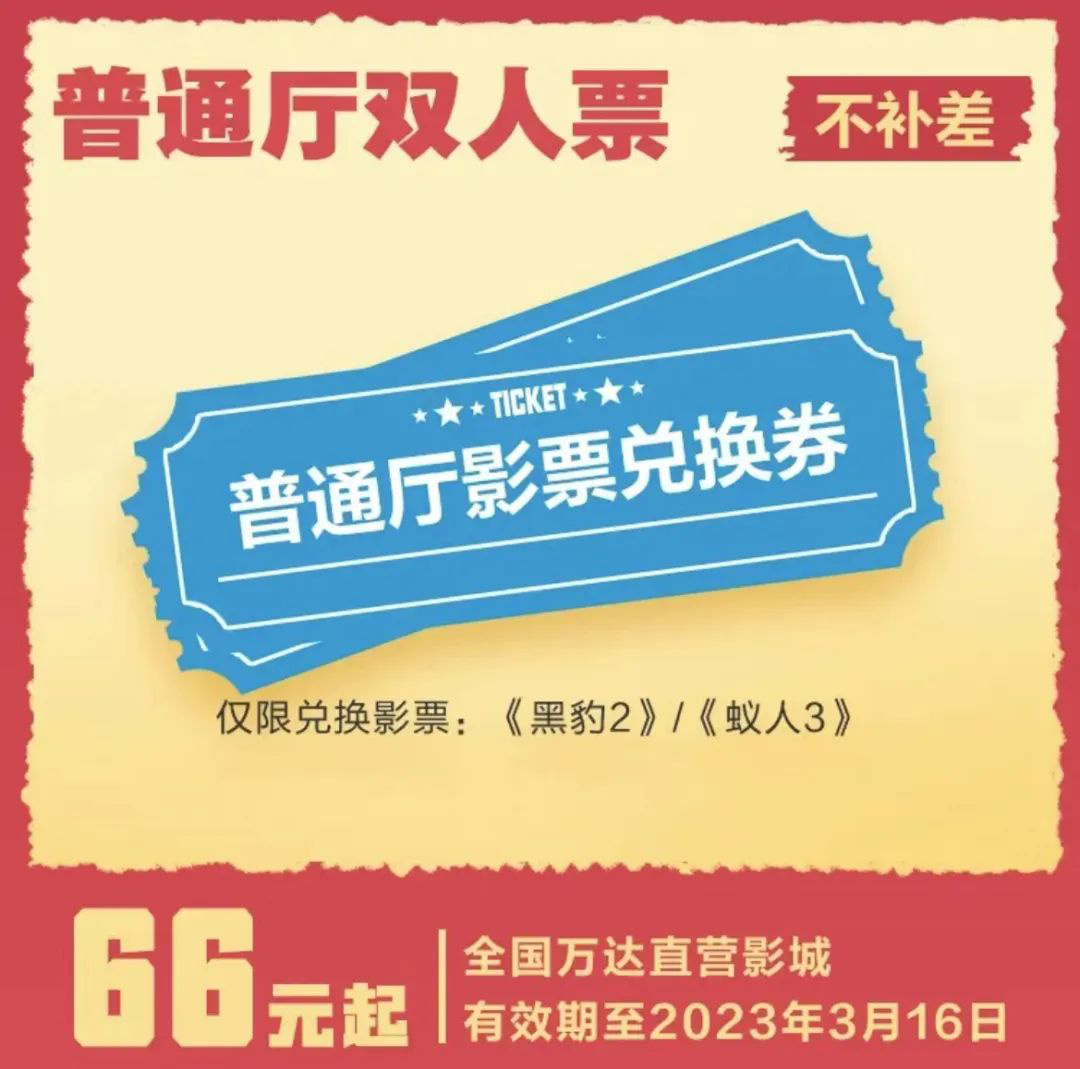

Image Source: Wanda Films

Image Source: Wanda Films