Editor’s note:

The wind swept

Everywhere is messy

Nine bodies shining through the leaves of the forest

Dark and misty, so far disappear.

Go through no one’s land

-Wang Qitong’s "Forest Leaves"

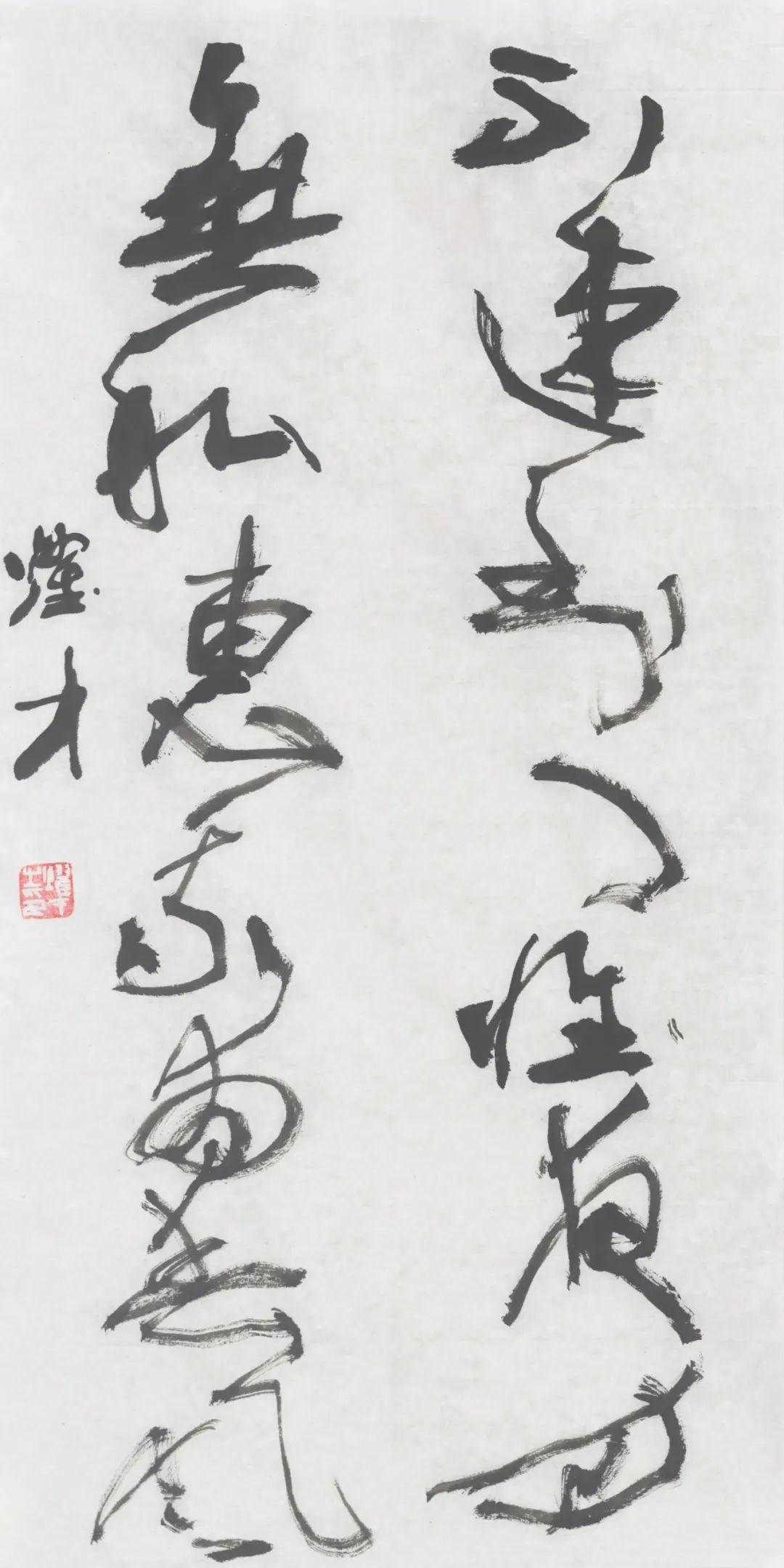

Ye caicai’s calligraphy

Bag monk "The Song of Transplanting Rice"

Hold the young crop Fukuda in your hand and bow your head to see the water.

After six clean roots make rice, it turns out to be forward.

138cm×69cm 2014

Reading Ye Cai’s new book art

Tim Chen

Calligraphy art is rooted in the main spirit of Chinese culture. The art of each era has the cultural characteristics of that time. In today’s multicultural society, the spirit of the times of calligraphy should be broad and compatible. When I read Ye Cai’s book, the first thing I thought of was these words.

Ye Cai is an early graduate student majoring in calligraphy and seal cutting in Guangdong Province. I studied calligraphy and Han and Wei rubbings under Professor He Shaojia and Professor Shang Tao. I have a unique understanding of the strong and simple style of calligraphy in the North School. After that, the style of calligraphy is fantastic and the weather is vigorous. Among the calligraphers in our province, his personal artistic style is more prominent, and what interests me most is his works in the "cursive state".

30cm× 69cm cursive script in the state of Ye Cai in 2022.

Cursive script is a wonderful style. I have been studying calligraphy for nearly 60 years, and I have copied many cursive scripts. Every time I see those excellent cursive scripts that are flying and smart, I can’t help sighing that my heart yearns for them, but I can’t. Crazy grass is the king of cursive script, and it is fascinating because it is deified, abnormal and inexhaustible. When watching the wild grass, we first feel its overall momentum, then the quality and rhythm of the lines, and finally recognize the font. Some scholars believe that the illiterate cursive script is lifeless and cannot be regarded as art. I think this is a problem worthy of serious discussion.

Ye Cai’s cursive script is 35cm×137cm 2018.

Ye Wencai once expressed his views on calligraphy art in his paper. He advocated that creative works should have a variety of interests and personalized expressions in different States, and attached importance to the initiation of artistic intuition on the basis of long-term tempering skills. It is required that writing techniques and composition should be dominated by temperament, and finally cultural calligraphy should be returned to "humanized" calligraphy, so as to realize the deep grasp of visual effects. Therefore, his "cursive rhythm state" works try to go beyond the state of Chinese characters and techniques, and express personal spirituality and feelings with unique line rhythm. I have discussed this issue with Ye Jun many times. He has repeatedly stressed that the calligraphy of "cursive rhythm state" is not to deny the past calligraphy tradition, but to develop on its basis. As for this attempt to break away from the Chinese character system, he also feels a bit like walking a tightrope. In my opinion, as a professional with graduate education, it is normal and necessary to make various attempts in art form. Road, is people come out. Success or failure depends on personal talent and social environment, unique creative spirit and the recognition of peers in the art world. Art should be allowed to explore, especially for artists with high talent and cultivation. Without exploration, there will be no development. Art needs innovation, and artistic innovation is also the pursuit of every real artist.

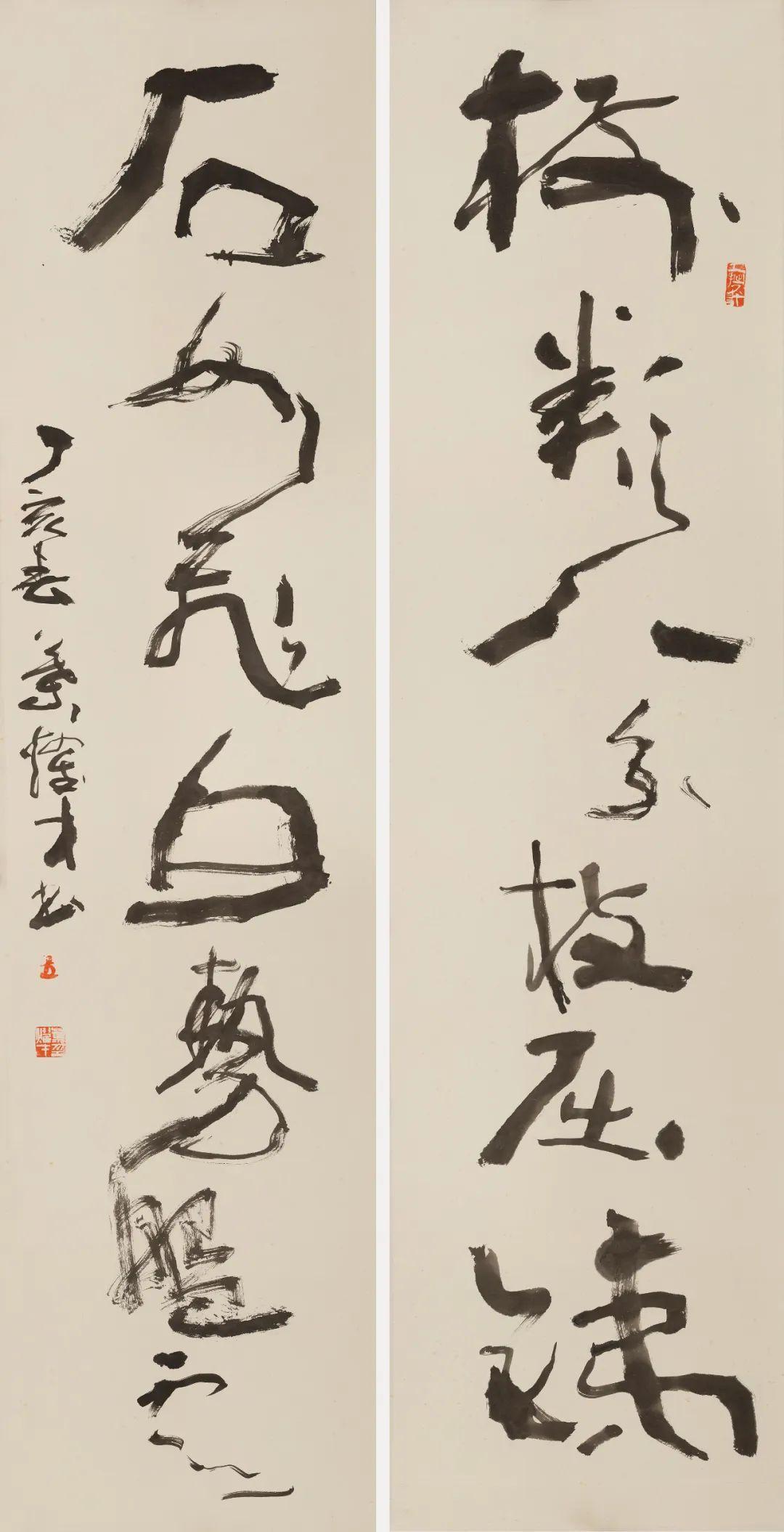

Ye caicai’s calligraphy

Gao Jianfu once wrote this couplet.

Firm but gentle is not a moon, a book is not a flower.

137cm×69cm 2014

I once wrote an article criticizing the "anti-tradition" tendency of contemporary book circles, and pointed out that it is easy to be in a desperate situation to talk about innovation. I advocate that young and middle-aged calligraphers should have a deep understanding of the profound traditional culture, make more efforts in calligraphy theory and practice, learn extensively, make a new start without seeking novelty, change themselves without seeking change, and become a family of their own, which is for the vast number of calligraphy lovers. In fact, a real artist doesn’t need others to tell him how to learn tradition and how to innovate. He will find his way. With the broad and compatible spirit of the times, artists can develop freely. Innovation is every artist’s dream, and a few of them may have their dreams come true. I sincerely wish Ye Wencai a team of his own in China book circles with his works of "cursive state".

(The original text is the preface of "Ye Cai’s state calligraphy exhibition". Published in the fifth issue of Collection and Auction of Guangdong Education Press in April 2005, People’s Daily on December 19, 2005, and Ling Zhai Cong Manuscript of Sun Yat-sen University Press in December 2011)

(Chen Yongzheng: Professor and PhD supervisor of Sun Yat-sen University, former vice chairman of China Calligraphers Association and former chairman of Guangdong Calligraphers Association)

Ye Cai’s cursive script is 136cm×70cm 2018.

Transcendence of abstraction

Zhang yanqin

Mr. Ye Yicai’s calligraphy exploration has attracted the attention of the industry. I especially value his non-verbal state cursive script.

This often reminds me of Mr Bing Xu’s gobbledygook. This brand-new and systematic contemporary art derived from the extremely tenacious and closed Chinese character ecology has strong conceptual value and artistic value.

The traditional calligraphy system faced by Mr. Ye Yicai is equally strict. His "state cursive" art, which transcends the "glyph", is also worthy of attention.

30cm× 69cm cursive script in the state of Ye Cai in 2022.

What is art? It can’t be defined. But what is certain is that artistic expression can become an important link in the structure of human civilization independently only after it is highly abstract. The abstraction of art is the premise for it to realize its transcendence value. This is true of all human artistic creations. Even pre-modern art and classical art seem to be very concrete, but to understand them, we must start from the abstract level.

For example, Song Huizong’s painting, many people say that it is too figurative, is it not artistic enough? Wrong. When we look at Song Huizong’s paintings, we never just look at what birds and flowers it paints, but feel its supreme elegance. When we look at Da Vinci, we not only look at its Madonna story, but also feel its strong religious feeling, which is quiet, serene, sacred and bright. This feeling is the supreme experience when we watch Da Vinci.

To understand human art, we should have an abstract concept. This so-called abstraction, which eliminates the boundary of image and bridges the gap of mind, is the undisputed greatest common denominator of mankind so far, such as music.

Ye Cai’s cursive script is 46cm×68cm 2018.

Mr. Bing Xu’s gobbledygook is naturally abstract, and its abstract significance lies in the infinite extensibility of its independently constructed system that bridges the Chinese and Western writing traditions.

Mr. Ye Yicai’s state cursive script is also abstract. Theoretically, it can effectively express all the expressions that human faces can present.

Because of this "infinite" cultural framework, it can have free meaning and transcend value.

Ye Cai’s cursive script is 138cm×35cm 2021.

Our ancestors have been inspiring us for a long time. Zhang Huaiguan, a Tang Dynasty scholar, said when he talked about calligraphy: Only look at the spirit, but you can’t see the font. This sentence can perfectly explain the origin of Mr. Ye Yicai’s state cursive script and "being a disciple of God". When Mr. Ye Yicai was forgetful in his creation, I believe that he has broken away from the shackles of functional expression, and what penetrated his mind is more philosophical and human nature.

Many years ago, I suddenly felt something about this, so I wrote a preface of hundreds of words in classical Chinese. After reading it, others gave feedback one after another, saying that it was quite literary in the Six Dynasties, but they couldn’t understand the content of the article at all. In fact, as the author himself, I don’t understand at all. Because it is an article that has no specific content at all and only expresses abstract charm-the so-called abstract classical Chinese. It is not a functional preface to other people’s exhibitions, but a contemporary work of art, and any response from any reader will form part of the work.

Because it is abstract, it is infinite; Because of infinity, it transcends.

The cursive script of Ye Cai’s state is 141cm×70cm 2020.

Travel all over the world

Cao Qiwen

Zhang Dai said that people can’t make friends without addiction. No addiction, no affection, no friendship. In the same way, people can’t follow the art without addiction. Art requires endless efforts, and addiction can’t persist at all. There are many kinds of arts in China, and I think calligraphy is the most difficult. People who engage in calligraphy are especially addicted. Less than one in a thousand people have practiced calligraphy to become calligraphers. Among the calligraphy styles, cursive script is the most difficult. Practice regular script and running script, write better, you can use it anywhere, and you will have more chances to be recognized as a calligrapher. In particular, there is no uniform standard for the two styles, which is generally understood by everyone. Secular people think that they are clever because of their strangeness, and they can write signs everywhere without much effort. Cursive writing is difficult. It has no practical function in modern times. People who read cursive writing are experts. If you want to write art, you will never be able to move forward and never rest. When you write the grass, your life will be consumed. Therefore, engaging in such a real art as cursive script is a risky and thankless way of life. Ye Zhen is one of the few people I have met who dare to engage in real art and become addicted to cursive writing. He has traveled all over Qian Shan for decades, and his lifelong spirit is worthy of recognition.

Ye caicai’s calligraphy

Seven-character conjunction

Spring boats are like sitting in the sky and old people are like fog.

43 cm× 69 cm in 2022

Ye E learned the cursive script of the Jin and Tang Dynasties and the Han and Wei Bei editions in his early days, and with a foundation, he worked hard on the calligraphy of Lin Sanzhi and Yu Youren. In fact, in decades of practice, he made full use of the omnipresent advantages of information after the reform and opening up, visited ancient and modern cursive scripts in China, and visited the forest of steles in the famous mountains and rivers grottoes. This condition has been set in Yu Youren and Lin Sanzhi. This determines that his cursive script is broader, braver, more varied, and more innovative, breakthrough and revolutionary. His cursive script, from Chinese cursive script to state cursive script, is the natural result of hard study and continuous improvement, and it is a natural artistic progress. His cursive script follows a solid and magnificent path, never being rash and clever. Calligraphy has a good sensibility and imagination in his heart, and he never plays ugly tricks. He fully understands the power of cursive script, and the cursive script in his works, in addition to the gentle and elegant style, is full of beauty and complexity: there are lines that can expand with heat and contract with cold, lines that run at high speed, lines that stretch smoothly, lines that swing and jump, and lines that collide with each other. Every line is a life, a thermonuclear energy and a lightning bolt, all of which constitute the beauty of words and layout. This is the result of his unremitting efforts for decades.

Ye caicai’s calligraphy

Su Dongpo’s sentences are connected

Black clouds turn over ink and white rain jump beads

138cm×35cm×2 2005

Mr. Cai is a streaker in calligraphy. He dares to go beyond the written facts and meet new feelings and experiences in addition to standardizing Chinese characters. He is a powerful innovative calligrapher. His cursive script transcends the common characters and enters the field of pure images. Cursive script itself is a will, a desire, a fight, a melody, a magical art, and a spiritual art! He doesn’t need to copy the lines of ancient and modern calligraphers, he just needs to give his cursive script a unique emotional color. This emotional color has its own rhythmic effect. The straightforward lines make cursive script naturally enter a new level, lead to a new direction and give it great freedom. It is no longer bound by the character symbols "form, sound and meaning", which makes the abstraction of points and lines in ancient cursive script more pure and the art more brilliant. His magic lines may confuse the world, but it must be admitted that a line is so rich in changes and so many rolling Pentium, but it has not been destroyed. This is the greatness of the state cursive script. Behind the profundity of the state cursive script, it contains the reconstruction of the cosmic order-both motion and stillness are geometric, which can reproduce the magnificent architectural structure.

To sum up, Ye Yicai’s state cursive script is the concept of big lines, which is a macro art.. The big shape, ups and downs, great rhythm and great breakthrough of cursive script are the call of the new art project. Well, brother Cai, congratulations, for your big line concept, continue to accumulate great power to express yourself-travel all over the world!

(Cao Qiwen: cultural scholar)

Ye caicai’s calligraphy

Eight-word couplet has true joy when climbing mountains near the water, and there is no vulgar feeling outside the flowers and books.

100cm×55cm 2014 2014

Self-preservation of law is used for people.

-Ye Cai cursive impression

zhiping chen

Not long ago, at a dinner party, I came across Mr. Ye Yicai’s sketch portrait series, which was vivid and subtle, and immediately refreshed all my previous knowledge of him, and also contributed to my desire to study his calligraphy works and theoretical works carefully. Mr. Cai is not only an outstanding artist and publisher, but also a thinker and practitioner of calligraphy. He has many contacts with Lingnan predecessors, and has been practicing calligraphy for many years. It seems that there is nothing wrong with calling him Chu Ting Yu Shu.

His thinking and practice of "state cursive script" can be described as unprecedented and unique. Starting from the origin of calligraphy, he traced back to the origin and brought forth the new, advocated the high unity of calligraphy artistry and culture, and the synchronous progress of linear thinking and music rhythm, trying to eliminate the boundaries between ancient and modern times and emphasize the integration of humanities. With a pen in one tube, it is too imaginary to overcome the shortcomings of cleverness, closure and superficiality. Achieve a state of self-confidence, self-sufficiency and self-release.

Ye caicai’s calligraphy

Seven-character conjunction

Flying down three thousands of feet I wonder why my inlaid harp has fifty strings.

43 cm× 69 cm in 2022

China’s calligraphy is not only the art of line, but also the art of qi. Whether there is mutual existence or not, the time and space are in harmony, and the brushwork is concise and full of variety. Mr. Xie Cai has a deep understanding here. The cursive script he made can be realized from all kinds of nature, developed from tradition, and developed from himself. He is vigorous and vigorous, writing with god, establishing himself by law and hiding it for people. Such as Yi Zhai’s color, the algae are brilliant, the talent is exquisite, and he has a number of his own. Other books are sharp in line, ancient in temperament, distinct in rhythm and dripping with ink. His books often have the tendency of chopping with an axe, but there is no trace of intention, which may be related to his long-term immersion in the Han and Wei Bei editions, and the unique use of God coincides with the vivid use of Jane Eyre.

Mr. Cai has been with me for years, but I know him very little. Those who know, besides painting and calligraphy, have made achievements in publishing, establishing publications and binding design; Occasionally, as an art critic, it can also criticize the shortcomings of the times, and it is an evergreen tree in the art world!

Mr. Cai asked me for comments, because he was redundant and admired me.

(Chen Zhiping: Director, Professor, Doctoral Supervisor, Director and Academic Member of China Calligraphers Association).

The cursive script of Ye Cai’s state is 140cm×70cm 2020.

State cursive script (excerpt)

Ye caicai

As a visual art, calligraphy, based on form and quality, develops to a high degree of interest, meteorology and charm, which is a path for the evolution of calligraphy itself. The description of calligraphy in ancient calligraphy theory is based on the meaning, brushwork, gesture and array of strokes. "If there are images in the vertical and horizontal directions, the book can be called" (in Cai Yong). Specifically, it is to hone the high-quality dotted lines in the long-term post, write wonderful Chinese characters and line rhythms, and write high-style images. Calligraphy requires the unity of form and spirit, which is a long-term cultivation of calligraphy from technology, culture and humanization. In a word, China’s calligraphy is a form of psychology based on metaphysics.

The brushwork means that everything is in the first line. In ancient times, the brushwork was based on natural interest, the dynamics of birds and animals, and the sense of sadness and excitement of human feelings. From the visual beauty of calligraphy, it was integrated into the humanistic qualities of poetry, literature, history and philosophy, and evolved into an abstract and boundless unknown field, which lasted forever. I never thought that ancient calligraphy was an art that had been fully developed. This basis is determined by the abstract characteristics of calligraphy ontology, which is "extremely simple" and even "extremely concise". Laozi’s thought of "knowing the white, guarding the black" and later generations’ "counting the white as black" are unique to China’s calligraphy. Extremely simple, it can contain profound and broad, so as to refine the meaning of high style and become a self-sufficient and endless art.

Ye Cai’s cursive script is 46cm×68cm 2018.

About the state cursive script.

State cursive script is a writing art which is divorced from the meaning of Chinese characters and only keeps the rhythm of cursive lines. Because it is a book without words, it is impossible and unnecessary to interpret it, aiming at the appreciation of the rhythm of lines. This is an exploration of "pure line visual music" with the separation of characters and books. The rhythm of its lines can be the leisurely and elegant walk of the two kings, the rushing ups and downs of Xusu all over the wall, the "heavy metal music" of landslides, and the mud-rock flow without trace. In the Internet age, what modern people know and feel is fully equipped with objective conditions that are not inferior to those of the ancients. At the beginning of this exploration into the unknown, it is impossible to break the wall unless it is strong … There will be primary and advanced stages of evolution. This exploration aims at fully excavating and carrying forward the core elements of calligraphy tradition: strengthening the quality of calligraphy lines and the richer changes of line rhythm after leaving the meaning of glyphs. At first, aiming at the ultimate pursuit of calligraphy ontology, it is more abstract than the known cursive script, trying to avoid the existing cursive script and trying to write a rhythm that is not in the tradition; Then write a new line rhythm image that is no less than the Chinese cursive classic-inspired by the integration of modern music into wind and thunder, electric shock rolling stones, glass, metal sounds, etc., not stick to one pattern, not avoiding glyphs; In the end, it will be a long journey of exploration to realize the natural muddy realm of the unity of mind and matter in cursive script.

The cursive script of Ye Cai’s state is 137cm×70cm 2020.

What is the difference between "state cursive script" and known "modern calligraphy"?

This involves the understanding and value judgment of calligraphy itself. The difference between a book and a painting is that it is linear and graphic, and that it is linear and rhythmic. Traditional calligraphy is a process from the square shape of seal script to the rhythm of cursive script. In "modern calligraphy", the school of few characters, the school of ink image, etc., the broad brushstrokes and texture presentation, although an exploration of writing art, have deviated from the ontology of calligraphy point-and-line rhythm by showing people in block pattern rhythm. Any writing that leaves the deep calligraphy skills and line rhythm, and all kinds of splashing ink that leaves the brushwork, is just a smear of "disguised to be obedient to painting". It can be an art, or it may just be self-mutilation in disguise in the sense of what the ancients called "evil, sweet, vulgar and dependent". The scale of the test depends first on what starting point it is, whether it has actually advanced or fallen backwards. In addition, it is the traditional calligraphy for writing Chinese characters. Jin people have long commented that "if it looks like an operator, it is not a book". To sum up, the person who writes Chinese characters is not necessarily calligraphy. Moreover, the form, sound and meaning of Chinese characters have been changing, and what remains unchanged is the dotted rhythm required by the pen. The ultimate pursuit of calligraphy is the shape, style and charm of dotted lines.

Ye caicai’s calligraphy

Five-character conjunction

Tao comes like a million horses and clouds come out like Yi Long.

138cm×68.5cm 2004

Calligraphy is abstract, inorganic, and the form and spirit are in harmony. Another important difference between calligraphy and painting, poetry and prose is the difference between the function of remembering things and the narrative function of painting and poetry. The "thing" recorded in calligraphy is not so much the matter of its text content as the "thing" of the form image and writing style triggered by the writer’s skills in the present mood and spirit. It should be noted that no matter how good the content of the text is, it is not as good as a few lines of Dunhuang scraps of paper. The fact that the meaning of words in calligraphy has given way to the meaning of words (the famous works in the history of calligraphy, such as Preface to Lanting, Sacrifice to My Nephew and Cold Food Post, have many clerical errors, rather than the fluent meaning of words) shows that the real ontology of calligraphy art has always been not the meaning of words, but the abstract beauty of calligraphy. This is undoubtedly the most essential feature of calligraphy itself.

Based on this, the state cursive script requires continuous deepening on the basis of the traditional cursive script, expressing the current temperament rhythm and striving to write a new visual language.

Ye caicai’s calligraphy

Seven-character conjunction

More than 3,000 years ago, there were 81 ancient writers with strange characters.

70 cm× 35 cm in 2021

Can’t you scribble without writing Chinese characters? Is there any difficulty in calligraphy skills?

State cursive is not scribbling. It is a kind of original innovation, but it has a high threshold in writing and writing. Its test standard: if anyone who lacks calligraphy, especially cursive script literacy, can write it, it is considered a failure. It is like the "hum" in vocal music. No matter how strong or weak the tone is, it also needs the support of breath, and it will also show the rhythm and rhythm style. It is not impossible to shout without singing the lyrics. Here, we may wish to compare the exploration of other modern calligraphy, all kinds of writing art and conceptual art, or we can see clearly.

The state cursive script is rooted in the high starting point of the traditional cursive script, and the difficulty and depth of the integration of book and meaning can be imagined after the concept of breaking the topic is separated from the calligraphy.

Ye caicai’s calligraphy

Li Bai’s "Confrontation with Youren in the Mountain"

The two of them have a cup after cup of flowers in Zhuoshan.

I was so drunk that I went to the Ming Dynasty to hold the piano.

100cm×55cm 2014 2014

Is there any restriction on state cursive script?

The so-called "grass method" is not only the accumulation of rich skills of ancient calligraphers, but also the continuous improvement of it. The ancient grass method is not only an important basis, but also not limited by it. The real grass method should be based on the current mood and spirit of the book, which has always been the case. If we blindly seek harmony with the past, the grass method in be adept at can also input data and be replaced by modern robots. This is exactly where the state cursive script appears in the contemporary book world, which is intended to break through.

The emergence of state cursive script has solved the following problems: Can calligraphy only be a reserved item of traditional culture? Can calligraphy enter modern times?

Some people think that "modern calligraphy" itself contains a paradox. Calligraphy is an artistic form and aesthetic norm that has been highly perfected and fully developed since Jin and Tang Dynasties. As long as it is China’s calligraphy, it can only last for generations. Therefore, as long as it is calligraphy, it cannot be modern, and as long as it is modern, it cannot be calligraphy. Calligraphy can only be a "quantitative extension of the old quality". The appearance of state cursive script in modern book circles has broken this paradox.

The cursive script of Ye Cai’s state is 137cm×70cm 2020.

The basis of this paradox stems from the cognitive limitation that only square Chinese characters are the ontology of calligraphy.

This limitation puts Chinese calligraphy in the practical level of glyph, so as to take it as the "conclusion" without doubt. This limitation has always made traditional calligraphy not fully developed in modern times, and it is "wanting to change but not knowing it" in the contemporary era of seeking novelty and change. Or give up the standard of calligraphy, or boast of pleasing foreigners (except sinologists and artists who really understand calligraphy) with "new ideas", euphemistically calling them going to the world, and even all kinds of ugly noises and pollution people’s eyes and ears.

Ye caicai’s calligraphy

Xishan yi Shi Ji Lian

Rocky pine is like a meal, and a summer guest leans against a stream, and flowers shine like a water person.

138cm×34cm×2 2007

It should be noted that the emergence and maturity of the wild grass since the Han, Jin and Tang dynasties show that calligraphy not only has the function of transmitting language information, but also is an art of expressing emotion and freehand brushwork with line rhythm and reaching spirituality. "Intention comes first, words come first", "A book on a piece of paper must have different meanings, not the same, and the meaning of the book must reach the Tao and be mixed with the yuan" (Wang Xizhi’s language). "He who knows books deeply can’t see the glyphs only when he looks at the colors" (in Zhang Huaiguan). The description of the meaning, form and spirit of calligraphy in the past dynasties shows that calligraphy, as a superb visual art, is dominated by the freehand "mind method" in terms of handwriting, brushwork, composition and ink method. The practice of "mind learning" in calligraphy freehand brushwork is always integrated on the basis of "metaphysics" in the meaning of Chinese characters. The abstraction of the combination of calligraphy and Taoism has an inexhaustible magical mystery. This is also the "state cursive script", which aims to connect the ancient and modern humanistic traditions. We should not only be satisfied with the classification, analysis, observation and research of calligraphy classics and turn them into specimens, but also activate this changeable tradition and then generate a chaotic pure yang body.

Ye caicai’s calligraphy

Introduction to Treatise on Febrile Diseases by Zhang Zhongjing

138cm×70cm 2021 2021

Introduction to Treatise on Febrile Diseases by Zhang Zhongjing

Every time I look at the diagnosis of the Vietnamese entering the country, I can’t help sighing for his talent, but I also blame the people who live in the world today for not paying attention to the study of medicine to cure the illness of the monarch and relatives to save the poor and humble, to preserve their health and to support their health, but to compete for glory and power, but to seek fame and fortune is to serve the end, to abandon its own beauty, and to strain its inner skin.

The prospect of state cursive script.

Compared with the cursive art, which has evolved for two thousand years, the breakthrough in theory and practice has become a reality. At present, the formation of state cursive script in style is only a matter of personal orientation, and the improvement and deepening of charm and style will require longer-term practice and more criticism with the same fate. The abstraction of the state cursive script does not deviate from and run through the profound humanistic tradition, and the prospect is predictable and optimistic.

Ye caicai’s calligraphy

Lu you’s cursive song

Su Dongpo wrote a book about Huangshan Valley.

35 cm× 276 cm in 2021

Lu you’s cursive song

Spending 3,000 stone to make wine and worrying about it is not equal to the wine.

At present, the world is narrow.

Suddenly, I swept away and I didn’t know it. I borrowed money from Huai Tian

The dragon fights in the wild, the fog is foggy, the strange ghost destroys the mountain, the moon is dark.

At this time, drive out all the worries in your chest, shout loudly and fall asleep.

Wu Gui and Shu Su are not happy to pay the high hall three zhangs’ wall.

Su Dongpo wrote a book about Huangshan Valley.

Lu Zhi’s book Er Ya uses the concept of equality as a side character

Travel tricks with the truth, and fine things with an open book.

Can be described as three evils

Ye caicai’s calligraphy

He Shaoji couplet

Xiuyun diverted water from the Qinshi River to Xiyan Lake.

70 cm× 35 cm in 2021

Ye caicai’s calligraphy

Seven-character conjunction

I don’t come to the door quickly, but jathyapple is selfless and I have a spring breeze

70 cm× 35 cm in 2021

Ye caicai’s calligraphy

Xishan yi Shi Ji Lian

Tree-like eight-branched ferrites are like flying white clouds.

134cm×35cm×2 2007

Ye Yicai: He has served as the editor and editor of Lingnan Fine Arts Publishing House; Press and Publication Member of China Calligraphers Association; Visiting Professor of Guangzhou Academy of Fine Arts; Distinguished researcher of Guangzhou Art Museum; Director of Guangdong Calligraphers Association; Member of Guangdong Artists Association; Director of Guangdong Humanities and Arts Research Association; Director of Guangdong Liao Bingxiong Humanities and Arts Foundation, executive editor of Calligraphy Art Series, Kang Youwei’s Handwriting, Centennial Tale, Complete Works of Liao Bingxiong, Cursive Art of Area Hidden Clouds, and editorial board of Collection and Auction.