The following article is based on Bottom Line Thinking, by Lu Ming

Bottom line thinking.

Observer network commentary column

Luming

Political letter financial practitioner, freelance writer

At the moment, any disturbance in Chinese real estate will not lack an audience.

In the beginning of 2024, the news of a "Hong Kong High Court order for China Evergrande to be liquidated" caused heated debate in the market. The debate was about how much assets could be liquidated and whether the liquidation was the best for Evergrande’s creditors. The Hong Kong Special Administrative Region government and the Chinese mainland High Court signed the "Minutes of the Talks on Mutual Recognition and Assistance in Bankruptcy Proceedings between the Mainland and the Hong Kong Special Administrative Region Courts" and the "Opinions on Launching the Pilot Work on Recognition and Assistance in Bankruptcy Proceedings in the Hong Kong Special Administrative Region" issued by the High Court, which seemed to block the impact of the liquidation order on Evergrande’s assets and business in the mainland.

In just two days, rumors of "Country Garden creditors applying for liquidation" spread like wildfire, and the creditors of real estate companies flared up. Although Country Garden refuted the rumors on February 1, the haze of "being liquidated" still hangs over Chinese real estate companies. On February 16, Longguang Group announced that the Hong Kong High Court had ordered the liquidation petition to be withdrawn; this was because Longguang Group had agreed on a workout plan with the creditor group of US dollar bonds and its advisers a month ago.

However, by the end of February, Country Garden was in the news again. Ever Credit Limited filed a winding-up petition against Country Garden in the Hong Kong High Court on February 27, involving about 1.60 billion Hong Kong dollars of outstanding loans. Country Garden’s latest response said that it firmly opposes the winding-up petition and will seek legal advice, take all necessary actions, and actively and properly defend with the advisory team.

Whether to choose to liquidate, continue to believe, or lie flat, deserves careful consideration by real estate company creditors. Although many people are eagerly looking forward to the stability and recovery of the real estate market, the market is still dead; such "calm" cannot help but wonder: Has the real estate industry become a thing of the past?

Yesterday, China Evergrande, today’s debt is "constant"

The "Evergrande myth" came to an end last September when Xu Jiayin, chairperson of Evergrande’s board, was taken into coercive measures on suspicion of illegal crimes.

Since then, the news about Hengda has continued to appear in the coverage, mainly about the progress of the property, the listed company’s valuation decline and suspension, workout and asset sale, until January 29 this year, Hengda creditors postponed the seventh liquidation petition hearing expired.

But during this period, the public seems to have "forgotten" Evergrande. Rather than "disappointment", it is better to call it "rational". Rationally view the evolution of Evergrande’s events, rationally think about the present and future of the property market, rationally respond to variables that appear at any time, and strive to solve practical problems related to themselves.

Figure 1 is a concise map of the business empire created by Xu Jiayin and his wife, which is controlled by China Evergrande Group (abbreviation: China Evergrande, stock code: 03333.HK), Evergrande Property Group Co., Ltd. (abbreviation: Evergrande Property, stock code: 06666.HK), China Evergrande New Energy Group Co., Ltd. (abbreviation: Evergrande Automobile, stock code: 00708.HK) and Evergrande Real Estate Group Co., Ltd. (abbreviation: Evergrande Real Estate).

Figure 1 (Source of information: According to the query information of Enterprise Early Warning)

China Evergrande is registered in the Cayman Islands, Evergrande Property and Evergrande Auto are registered in Hong Kong, and Evergrande Group and Evergrande Real Estate are both registered in Shenzhen. Evergrande Group is the main commercial entity of China Evergrande except real estate business, covering high-tech, finance, Internet, modern agriculture, health industry, education technology, think tanks, sports, amusement parks, restaurants, hotels and other sectors.

According to the 2023 interim report of China Evergrande and its subsidiary Evergrande Real Estate, Evergrande Group’s consolidated caliber total assets are 1.743997 trillion yuan, consolidated caliber liabilities are 2.3882 trillion yuan, and consolidated caliber owner’s equity is -644.203 billion yuan, which is seriously insolvent. Consolidated caliber interest-bearing debt [Interest-bearing debt includes senior notes, corporate bonds, convertible bonds, bank loans and trusts and other non-standard financing.] The total amount is 624.765 billion yuan, and Evergrande Real Estate accounts for about 70.87%, which is 442.754 billion yuan.

Among them, the amount of interest-bearing debt denominated in US dollars and Hong Kong dollars is equivalent to RMB 157.896 billion yuan and 6.239 billion yuan respectively, accounting for 26.37% of the total interest-bearing debt of Evergrande Group. There are 14 Chinese dollar bonds, totaling 19.5454 billion yuan: 10 Chinese Evergrande headquarters, totaling 14.3104 billion yuan; 4 Hengda real estate, totaling 5.2314 billion yuan.

It can be seen that Evergrande (hereinafter referred to as "Evergrande" to refer to the enterprise group composed of China Evergrande and its subsidiaries) has a relatively low proportion of overseas debt, and mainly uses indirect financing methods.

Evergrande has a debt of 2.40 trillion yuan, of which interest-bearing debt is only a quarter. Other liabilities mainly include: payments due to suppliers (including real estate and trading businesses, etc.), accounting for about a quarter; advance payments from home buyers, accounting for about a quarter; payables from third-party lending, partners’ upfront investment, acquisition of land use rights and project company equity, accounting for about one-eighth; and deferred income tax liabilities, accounting for about one-eighth.

The "Updated Announcement on Hengda Real Estate Involving Major Litigation and Failure to Liquidate Due Debts" released on December 29, 2023 shows that as of the end of November 2023, Hengda Real Estate had involved a total of approximately 316.391 billion yuan in unliquidated due debts, and a total of approximately 205.537 billion yuan in overdue commercial tickets.

The above data is only financing data. Payments due to suppliers, partners’ upfront investment, and other payables are scattered among thousands of pending lawsuits and cases of dishonest enforcers. The balance of prepaid house purchases by house buyers is slowly reduced along with the "guaranteed buildings" one by one.

Domestic debt "is not debt", foreign debt will "kill"

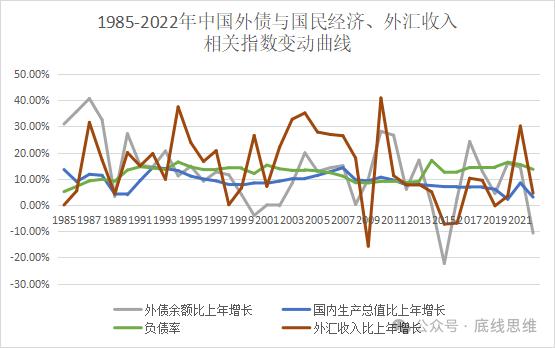

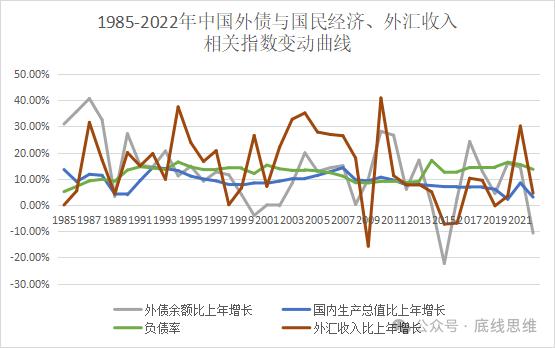

Figure 2 shows the change curve of relevant indicators drawn by the author according to the statistics of the State Administration of Foreign Exchange’s "China’s External Debt, National Economy and Foreign Exchange Earnings, 1985-2022".

From the graph, it can be seen that the growth rate curve of external debt balance and the growth rate curve of foreign exchange income have the same trend; the GDP growth rate curve has a strong correlation with the debt ratio curve, and both are relatively flat.

According to the data of the State Administration of Foreign Exchange, in 2001, China’s foreign exchange income was 299.40 billion US dollars, and the balance of foreign debt was 203.30 billion US dollars. Before 2001, the annual foreign exchange income was slightly higher than the balance of foreign debt. After 2001, thanks to China’s accession to the WTO, the annual foreign exchange income and the balance of foreign debt quickly widened. By 2022, China’s foreign exchange income 3.5552 trillion US dollars, and the balance of foreign debt 2.74656 trillion US dollars.

The rapid growth of foreign debt and foreign exports is the best example of China’s export-oriented economy in the past 20 years. The perfect match between the debt ratio and the GDP growth rate further confirms the good effect of using foreign debt to promote economic growth.

Figure 2 (Note: 1. Debt ratio refers to the ratio of the balance of foreign debt at the end of the year to the GDP of the year; 2. Foreign exchange income refers to the export income of goods and services on the basis of the balance of payments.)

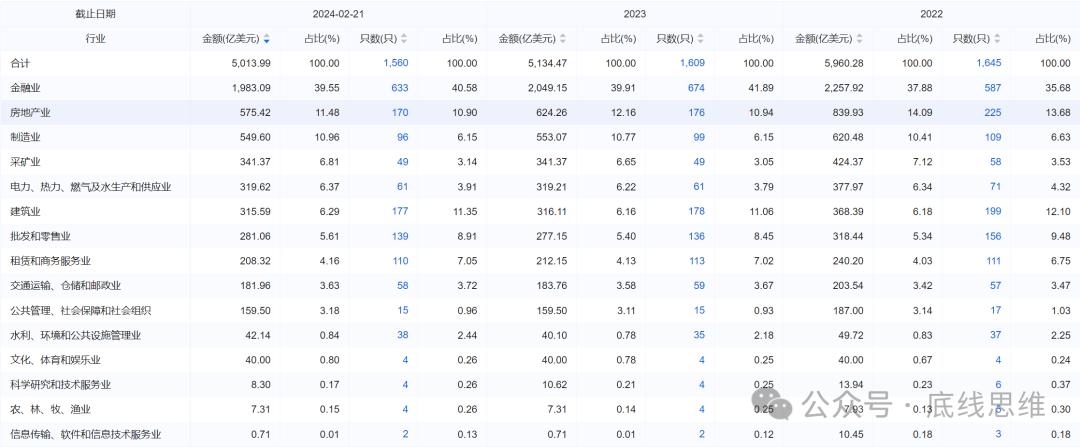

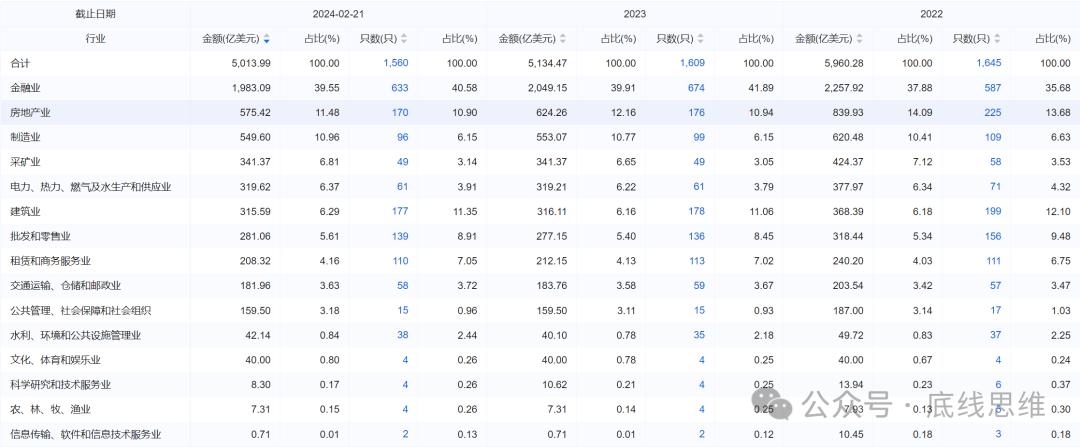

Figure 3 shows the stock amount of Chinese dollar bonds issued by enterprises in various industries and the relevant statistics. Among them, financial enterprises issued the most, followed by real estate enterprises.

As of February 21, 2024, the balance of US dollar bonds issued by real estate enterprises was 57.542 billion US dollars, a decrease of 31.49% from the US $83.993 billion at the end of 2022. It is expected that the repayment tide of US dollar bonds of real estate enterprises will continue. Since 2023, the number of new US dollar bonds issued by real estate enterprises has dropped to single digits. In addition to leading real estate enterprises such as Shanghai Jinmao, Yuexiu Real Estate, Wanda Commercial, and Swire Real Estate, only a few urban investment companies with real estate as their main business are left.

Figure 3 (Data source: Enterprise Early Warning)

According to Evergrande’s interest-bearing debt structure data, its foreign debt accounts for less than 30%. But it can be said that it is precisely because of this small amount of foreign debt that Evergrande has been "guillotined".

Why are Hengda’s domestic debt creditors, including home buyers, suppliers, partners, and Financial Institution Group, willing to give Xu Jiayin and Hengda some time, while foreign creditors are impatient and even want to take advantage of the fire? Not to mention that there are very few left after the liquidation of Hengda, even if according to the order of debt repayment, foreign creditors are not preferred.

Perhaps it is because foreign creditors handle economic affairs strictly in accordance with the concept of "rule of law" and business habits; perhaps it is because domestic creditors have a more accurate grasp of the current economic environment and economic situation, and optimistic expectations dominate; perhaps some people take the opportunity to short Chinese real estate and play arbitrage games… At present, there is not enough evidence to verify the above speculation.

But there is one point that deserves the attention of domestic enterprises, that is, they must reasonably and moderately borrow foreign debt for production and operation based on the needs of the enterprise’s operation, and at the same time deal with creditors in accordance with the market economy system and rules. For the content of reasonable and moderate borrowing, readers can refer to the author’s previous article "Private enterprises lack money, what else is missing?" on the relevant discussion of "the advantages and disadvantages of equity financing and debt financing".

We must not handle and treat foreign affairs with the concept and style of handling domestic debts, that is, "politicization of economic issues". The political structure must be necessary, but it can only be used as a means of backing the bottom line, and it should not be overused, so as not to cause "discredit" and cause pessimistic expectations. Borrowing foreign debt involves a wide range of aspects. The State Administration of Foreign Exchange, the National Development and Reform Commission, and the Ministry of Commerce of China and other departments will participate in the guidance to varying degrees according to the amount and purpose of borrowing foreign debt. Rashly imposing administrative intervention is not only contrary to commercial credit, but also will damage the image of our country’s socialist market economic system and cause a series of adverse reactions.

External debt is sensitive to factors such as exchange rates, interest rates and geopolitics, and the variables are large. A little carelessness will trigger the liquidity risk of the borrower, which will cause a debt crisis and disrupt the rhythm of production and operation. If the industry risk is superimposed, the borrower will fall into the abyss, just like Evergrande.

Will Hengda’s liquidation be followed?

The liquidation of China Evergrande is the end for Xu Jiayin and his business empire. But is this wave of liquidation just beginning for China’s real estate industry?

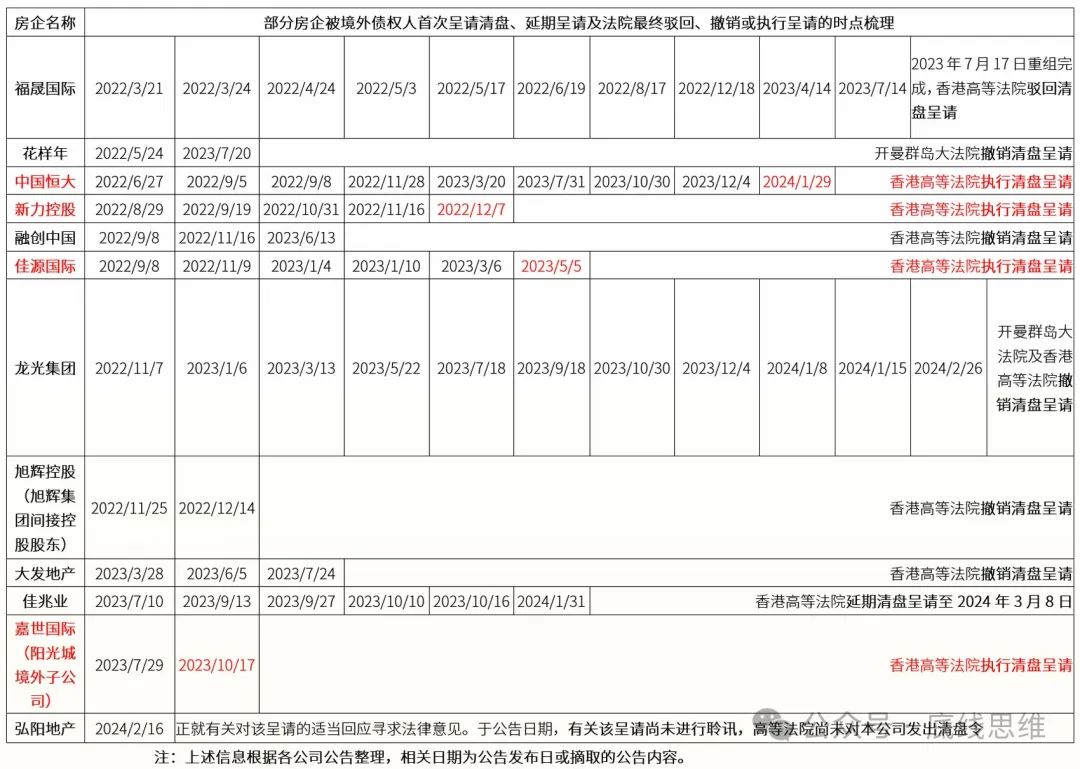

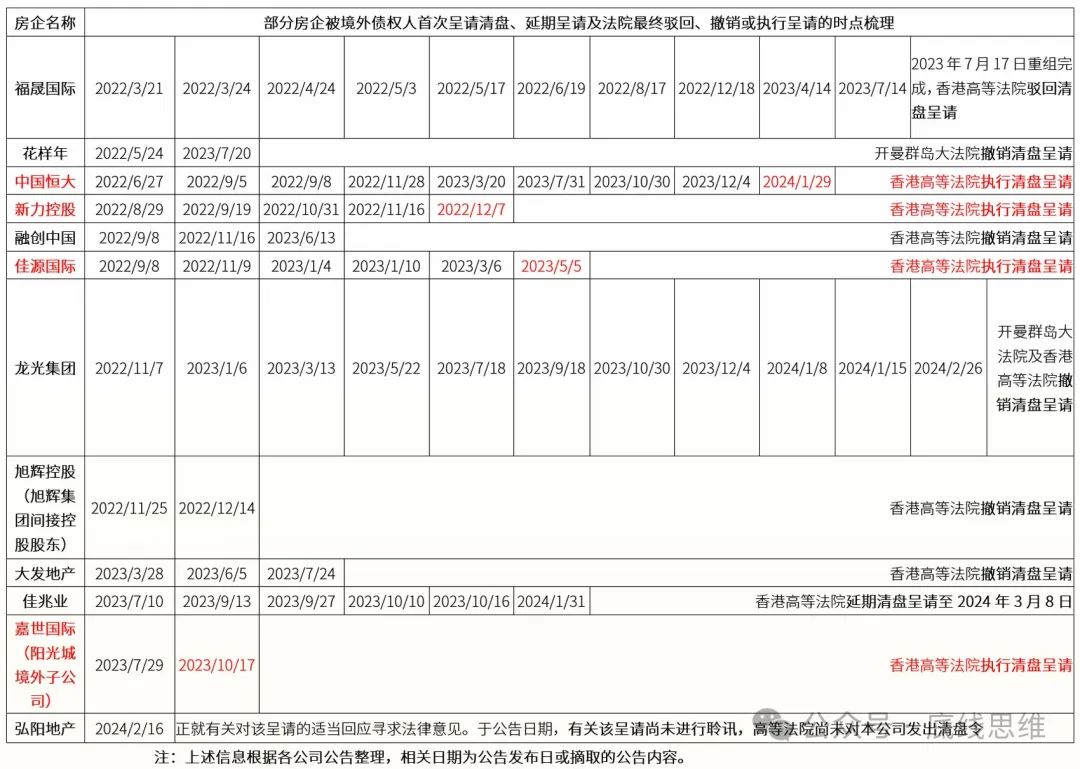

The following table is based on the announcements of some well-known real estate enterprises and their related parties. It is not difficult to find that there are not a few real estate enterprises that have been liquidated by creditors of overseas debts. The first liquidation petition is concentrated in 2022, and the first application for liquidation of individual real estate enterprises occurs in 2023 and 2024.

Judging from the judgments of the Hong Kong High Court and the Grand Court of the Cayman Islands on the winding-up petition, there are four orders: dismissal, adjournment, revocation, and enforcement. Each order is issued prudently, and is based on the actual situation of the real estate enterprise, the feasibility of the workout, and the approval of creditors. The legal details are left to legal experts to interpret, which will not be covered in this article for the time being.

Table 1 (Note: The above information is collated according to the announcements of each company, and the relevant date is the announcement date or the content of the excerpted announcement.)

However, one thing worth noting is that whether the company chooses to lie down or save itself determines the sooner or later the liquidation petition will be executed. Among the real estate companies that have been liquidated, Sunshine City is undoubtedly the flattest. The first application for liquidation was executed without even a trace of struggle. How can we talk about self-rescue, let alone sincerity?

Sony Holdings was liquidated in December 2022, and the Stock Exchange cancelled its status as a superior company on April 13, 2023. The progress and details of its liquidation cannot be obtained through public channels for the time being. Jiayuan International was liquidated in May 2023, and the liquidation work is still in progress, during which the stock continued to be suspended.

According to the "Latest Information on the Group’s Business Operations and Proposed Restructuring" released by Jiayuan International on January 30, 2024, it is time-consuming and laborious to sort out its domestic and foreign debts. Not only does the liquidation require financial support from creditors, but the remaining rights and interests cannot be fully protected when the restructuring is completed. The following is an excerpt of the original text:

"The Liquidator believes that the proposed protective action may be an arrangement made by the onshore creditors and/or the local government to facilitate the completion and delivery of the housing project and/or the segregated protection of the value of the Qingdao Real Estate Development Project…. As of the date of this announcement, the outstanding principal amount (excluding any accrued interest) payable to the Lender by Cheung Yuen Properties (an indirect wholly-owned subsidiary in Macau) under the financing agreement is approximately HK $3.20 billion. As a result of the appointment of the Receiver, the Group no longer has any power or authority to dispose of Bright Ocean shares and all assets of Bright Ocean, including the interest in Xiangyuan Real Estate…. On January 19, 2024, Guangyuan Mining (an indirect wholly-owned subsidiary in Cambodia) received a reminder notice from CITIC Xinhui to repay its debts totaling US $129,620,620.35 by January 26, 2024, otherwise CITIC Xinhui indicated that further legal action may be taken against Guangyuan Mining…. It is expected that the impact of the above-mentioned development of the company’s domestic and overseas operations will result in a significant decrease in the net asset value of the Group compared to the net asset value disclosed in the recently published consolidated statement of financial position as at June 30, 2022…. There is no doubt that in the absence of sufficient funds, it will not be possible to Achieving a successful restructuring… The liquidator seeks the continued support of all the company’s creditors and their patience throughout the process. "

Looking back at Hengda, the company and its executives, as well as the actual controller Xu Jiayin, have been actively communicating with creditors, local governments and people from all walks of life. Sorting out Hengda’s announcements and related information reports, most of them are workout progress, property protection, and asset sale. It can be seen that Hengda has not been lying flat, and it is Hengda’s full sincerity and active self-rescue actions that have repeatedly postponed the liquidation petition.

So, is it because of a series of events such as Xu Jiayin’s technical divorce, filing for bankruptcy protection in the United States, and being forced to take coercive measures that creditors have lost patience and confidence, accelerating the arrival of liquidation? The author believes that it is not unrelated, but it should be mostly rational. After creditors have a deep understanding of Evergrande, they have combined the real estate industry, domestic economy, and international environment to make a comprehensive evaluation of "the lesser of two evils".

Petitioning for liquidation is not an end, but a means for creditors to fight for their rights and interests. It is a helpless move to negotiate fruitlessly. Whether foreign creditors of other real estate companies will petition for liquidation one after another depends on whether real estate companies really want to be liquidated.

For domestic creditors, it seems that the option of applying for liquidation is missing, but it is actually abandoning the forced negotiation measure of "breaking the jar". After all, the problems currently encountered by real estate enterprises are similar. It is not so much a debt crisis caused by excessive debt, but an inevitable outcome of the industry’s risk clearing.

Thousands of sails pass by the side of the sunken boat

According to the above-mentioned cases of several real estate companies that have been ordered to be liquidated by the Hong Kong High Court or overseas courts, Evergrande’s liquidation will take a long time. After all, Evergrande’s volume is very large, involving a lot of business and a wide range of regions. Moreover, the task of protecting the property in China is still arduous, and litigation and enforcement have yet to be realized. Recently, Sean, CEO of Evergrande Group, said that the management and operation system of domestic and foreign subsidiaries of Evergrande Group and other independent legal entities remains unchanged, and key tasks such as protecting the property are steadily promoted.

Standing at the current point, Evergrande’s liquidation has caused the market to feel the "cold spring", and foreign creditors have launched a wave of "counterattack" in response to the cold snap – on February 16, 2024, Hongyang Real Estate (1996.HK) issued an announcement, and Bank of New York Mellon London Branch submitted a liquidation petition to the Hong Kong High Court, involving financial obligations of not less than 228,500,000 US dollars, which has not yet entered the hearing.

Other foreign real estate creditors are also waiting for an opportunity. What are they waiting for? Presumably not to petition for liquidation. Maybe it is waiting for the company to cut meat and sell assets cheaply; maybe it is aiming at the opportunity of bottom fishing and preemptively occupying land; of course, it may also be purely to rip off. But these actions are beyond reproach in the end. As for the market, compliance can be done.

The market is rational, and all parties are pursuing maximum profits. Only by withstanding the test of liquidation can we proceed steadily and far in the next real estate cycle.

Infographic/Dongfang IC

Can real estate become a breakthrough for economic boost again?

Since November last year, the People’s Bank of China and other eight departments jointly issued the "Notice on Strengthening Financial Support Measures to Help the Development and Growth of the Private Economy", real estate enterprises have received financing support from commercial banks and other Financial Institutions Groups to varying degrees.

It is reported that as of February 20, 214 cities in 29 provinces across the country have established a real estate financing coordination mechanism, and put forward a "whitelist" of real estate projects that can be supported by financing in batches and pushed to commercial banks, involving a total of 5349 projects; 162 projects in 57 cities have received bank financing for a total of 29.43 billion yuan, an increase of 11.30 billion yuan compared with before the Spring Festival holiday.

There are many opinions that at this stage, for real estate enterprises, they should first focus on the resolution of their own debt crisis. Get cash flow through high-quality asset disposal, and the strong man will break his wrist; or through other business sectors, or even the real estate sector compensated by the actual controller’s private assets, seek balance… The above-mentioned debt schemes are correct, but they cannot solve the fundamental hematopoietic problem. Short-sighted solutions to problems will not only dampen the enthusiasm of creditors, but also dampen the enthusiasm of a large number of enterprise managers.

Housing enterprises self-rescue blood, Financial Institution Group blood transfusion, is a top priority, help boost market confidence. However, the real estate enterprise debt high this drawback, in the process of rapid development of the real estate industry, eventually led to the debt crisis. Therefore, the solution should also be found in the continued development.

Since the beginning of this year, many first-tier and super-first-tier cities have relaxed their residential purchase restrictions. At the same time, monetary policy has also been actively implemented: on January 24, the People’s Bank of China announced that the deposit reserve ratio of the Financial Institution Group will be reduced by 0.5 percentage points from February 5, 2024 (excluding the Financial Institution Group that has implemented the 5% deposit reserve ratio); on February 20, the People’s Bank of China authorized the National Interbank Offered Center to announce the loan market quotation rate (LPR): The market quotation rate (LPR) for loans with a maturity of more than five years was reduced from 4.20% to 3.95%, a decrease of 25 basis points from the previous value.

Zhang Xu, an analyst at Everbright Securities, said, "This is not only the first LPR decline since August 2023, but also the first time since May 2022 that the LPR decline formed by the active compression of the MLF (medium-term lending facility) interest rate remains unchanged. It is also the largest single decline since the LPR reform, and it is a single decline that far exceeds market expectations… It will help support the stable and healthy development of the real estate market."

All eyes are on the real estate market, and most of the good news has been given. Can the real estate industry become the engine of stable economic growth in the "post-epidemic era"?

Pessimists are right, optimists move forward. With the implementation of monetary policy, debt risk will be transferred from the real estate industry to the commercial banking sector, and to a certain extent, it will be borne by the residential sector. It is necessary to pay attention to the local risks exposed in the process of risk transfer, such as the risk of excessive bad debt ratio of small and medium-sized banks. AMC institutions may be able to cover it to a certain extent.

In addition, fiscal policy should be more active. Advancing the construction of affordable housing, "dual-use" public infrastructure, and "three major projects" for the renovation of urban villages can help the real estate market stabilize and recover, and real estate enterprises can achieve appropriate replenishment. In the future, whether the development of housing rental market and commodity housing market can shine greatly depends on whether the macro economy can continue to improve.

Source | Bottom line thinking

Continue to swipe to see the next one.

Evergrande is liquidated, what kind of game is China’s real estate facing? Observer Network, light touch to read the original text

Observer network, like sharing, watching, write a message, swipe up to see the next one

Original title: "Evergrande liquidated, what game is China’s real estate facing?"

Read the original text