Yesterday, the website of the Ministry of Transport released the "Exposure Draft". The exposure draft proposes that the facilities configuration and vehicle performance indicators in the online taxi-hailing car should be significantly higher than that of the local mainstream cruise taxi. Drivers should wait for orders at permitted parking places, and should not cruise around to pick up customers. They should not set up unified cruise car dispatching service stations or places that implement queuing. Riders or passengers can settle by cash or non-cash payment methods; after arriving at the destination, they will take the initiative to provide passengers with the corresponding local taxi invoice.

The public comment period is one month and ends on August 31.

The success rate of booking a car should reach more than 80%

On July 29, the State Council Information Office held a press conference to officially release the "Guiding Opinions on Deepening Reform and Promoting the Healthy Development of the Taxi Industry" and the "Interim Measures for the Administration of Online Booking Taxi Business Services", announcing the legalization of online car-hailing and making it clear that the new regulations will be implemented on November 1.

Yesterday, the website of the Ministry of Transport released the "exposure draft" (hereinafter referred to as the "exposure draft"), soliciting written comments from the public for a period of one month until August 31.

It is understood that the preparation of the specification is led by the Highway Science Research Institute of the Ministry of Transport, and the preparation team is composed of relevant experts and personnel from industry management departments, taxi operators, and platform enterprises.

According to Cheng Guohua, an associate researcher at the Development Center of the Institute of Highway Sciences, this specification is a recommended industry standard accompanied by two documents.

The so-called recommended standards, also known as non-mandatory standards or voluntary standards, are not mandatory.

The exposure draft standardizes the terms and definitions related to the operation of online booking taxis, clarifies the basic requirements of online booking taxi operators, transportation vehicles, drivers, etc., defines the service processes of online booking taxi operators and drivers respectively, and regulates the handling of special circumstances, service evaluation and complaint handling.

The exposure draft lists five 100% indicators for online car-hailing services, including reservation response rate, vehicle compliance rate, driver compliance rate, qualified rate of operating vehicle insurance purchase, and passenger complaint handling rate.

In addition, the success rate of ride-hailing and the passenger satisfaction rate of third-party surveys are required to be greater than or equal to 80%. For the unsatisfactory rate of passenger service evaluation, it is required to be less than 20%. The effective complaint rate of passengers is less than 20 parts per million.

Ride-hailing drivers should not parade to pick up customers

The State Office’s "Guiding Opinions" make it clear that taxi services mainly include cruising and online booking. According to the definition of the "Interim Measures for Administration", online car-hailing provides "non-cruising booking taxi services". In this regard, the exposure draft further clarifies that online car-hailing "In the operation of services, drivers should not cruise around to pick up customers, and should not set up unified cruise car dispatch service stations at airports, railway stations and other places that implement queuing to pick up customers".

What should the driver do if the passenger does not arrive at the boarding location as agreed?

According to the draft, the driver should contact the passenger or operator to confirm that the waiting time can be agreed upon by both parties, generally not less than 10 minutes. If the passenger has not arrived beyond the agreed waiting time, he should contact the operator and leave after approval.

For online taxi operators, the exposure draft makes it clear that they "shall bear the liability for advance compensation for safety liability accidents that occur during the service process, and shall not transfer the risk of transportation services to passengers and drivers in any form".

It is recommended to equip the online car with free WiFi.

The exposure draft makes it clear that the in-car facility configuration and vehicle performance indicators should be significantly higher than the local mainstream cruise taxis, and Internet wireless access, mobile phone chargers, paper towels, etc. should be provided for passengers to use. The "Reservation Taxi Transportation Certificate" and "Reservation Taxi Driver’s License" should be carried with the car.

In this regard, Cheng Guohua said that the "Interim Measures for Management" stipulate that online car-hailing should be developed in an orderly manner in accordance with the principles of high-quality service and differentiated operation. Compared with traditional cruise taxis, how to reflect "high-quality" and "differentiation"? Vehicle grade is an important aspect.

The reporter learned that some special cars can currently meet the standards set by the regulations, but the price of express cars is significantly lower than that of cruise taxis, and cannot meet this standard. Some express drivers told reporters that charging can be provided with little effort, but providing mobile networks, bottled water, etc. will increase costs, making it difficult to provide income.

Cheng Guohua admits that there is a clear difference between special cars and express cars at present. The "Interim Measures for Management" clearly state that online car-hailing should reflect "high quality", and the specific standards should be determined by the local area. As a whole, it should reflect the difference between new and old business formats and reflect different business ideas.

The order should be consistent with the service vehicle personnel.

In response to the different issues between vehicles and drivers, the exposure draft makes it clear that real-time dynamic monitoring of vehicle operation and service processes should be carried out by installing on-board end points and other means to ensure that the service vehicles provided by the network service platform (also known as online) are consistent with the actual (also known as offline) service vehicles. During operation, personal biometric data such as driver portraits should be collected in real time and compared with the driver’s uploaded identity information to ensure that the online service drivers are consistent with the offline service drivers.

Cheng Guohua introduced that online and offline inconsistencies are currently a more prominent problem in online car-hailing. For example, in May this year, a female teacher in Shenzhen was killed while riding an online car-hailing; a national electronic sports runner-up in Changsha was cut off. In reality, there are cases of defaulting vehicles receiving orders, and there are also cases where drivers take friends’ mobile phones to receive orders. The Interim Measures for Management make it clear that the platform must ensure online and offline consistency, and the registered drivers are consistent with the drivers who provide services. How to ensure this consistency? Through technological means. Cameras and other devices must be installed on the car, which are guaranteed through biometric technology.

The reporter learned that there are some full-time online car-hailing drivers who rent cars in two shifts to engage in service. In this regard, Cheng Guohua said that the norms only stipulate the consistency between online and offline, and do not limit a car to only one platform, or only one driver per car.

Instant ride-hailing shielding destination anti-pickup

The exposure draft defines terms related to online ride-hailing. For example, an instant ride-hailing service is "a service with a time interval of not more than 30 minutes between the appointment time and the arrival of the vehicle at the agreed pick-up location".

The exposure draft requires that online ride-hailing platforms "should not refuse the request of the driver to reserve a car within 3 days".

In order to ensure the information security and personal safety of passengers, the exposure draft makes it clear that the client side application should have the following functions: personal phone encryption function, communication between passengers and drivers through technical means; "one-click call" function, when passengers are used in emergency situations, real-time dynamic information of the vehicle and driver information can be automatically sent to the network about the car operator; the evaluation results of passengers’ single service behavior should not be directly fed back to the driver.

The reporter learned that Uber, Didi and other online car-hailing software have encrypted personal phone calls. According to Cheng Guohua, most mainstream online car-hailing software already has a "one-click call" function.

Exposure draft proposed that for instant car service, platform push information should block the location of passengers getting off.

Why block passengers’ destinations? Cheng Guohua explained that in traditional cruise cars, some passengers will encounter such a situation: that is, after telling the driver where to go, the driver says he can’t go, that is, the situation of refusing to pick up passengers and picking up passengers. In online ride-hailing services, if the platform lets the driver know the passenger’s destination, it provides conditions for him to pick up passengers and refuse to pick up passengers. Based on this, the platform is required to block passengers’ destinations.

Passengers can choose to settle the fare in cash

While almost all ride-hailing apps currently settle online, the exposure draft proposes that "upon arrival at the drop-off location, the platform should inform the ride-hailing service fee via mobile phone text message or client side app, and the ride-hailing person or passenger can settle by cash or non-cash payment."

In this regard, Cheng Guohua explained that the regulation is made from the perspective of protecting the rights and interests of passengers. Although most online ride-hailing users accept online settlement, it is not ruled out that some passengers pay cash for the security of their bank accounts or because WeChat does not have enough money.

Regarding invoicing, the exposure draft makes it clear that "after arriving at the destination, take the initiative to provide the corresponding local taxi invoice to the passenger, unless the group user issues it uniformly or the driver and passenger request otherwise".

Cheng Guohua said that the "Interim Measures for the Administration of Online Taxi-hailing" implement clear pricing, and provide passengers with corresponding taxi invoices ". In this regard, the exposure draft further clarified that the invoice should be a local taxi invoice. Generally speaking, taxis have to give invoices in person, that is," issue ", but there are some special circumstances in online taxi-hailing that cannot be issued on the spot, which requires" providing "invoices. These special circumstances include: for example, group users, who have charged a lot of money at one time, and the invoice has already been issued; for example, if the passenger has a request, take a taxi and save up for a period of time, and then send it at one time.

> > Related News

All localities should formulate detailed implementation rules for online car-hailing within 3 months

Beijing Times News (Reporter Sha Xueliang) A few days ago, the Ministry of Transport issued a notice on the implementation of the "Guiding Opinions of the General Office of the State Council on Deepening Reform and Promoting the Healthy Development of the Taxi Industry" and the "Interim Measures for the Management of Online Booking Taxi Business Services" (referred to as the two documents), requiring local transportation authorities to complete the formulation of the implementation details within three months under the leadership of the city people’s government, based on the two documents and combined with local conditions.

The notice pointed out that the two documents give the local full autonomy and policy space, local authorities to develop detailed implementation rules, not only to respond to the general concerns of the people’s personalized travel, but also to take into account the reasonable interests of taxi industry operators and employees, coordinate the demands of all parties, to ensure that the reform policy to achieve the greatest common denominator, feasible measures, strong operability. For major decisions such as the reform of the right to operate, the launch of the policy to standardize the management of online car-hailing and the transition plan, it is necessary to carry out social stability threat and risk assessment, improve the emergency plan, and ensure the steady and smooth progress of various reforms.

It is reported that the Ministry of Transport will soon convene the relevant comrades of the transportation departments of the provinces (autonomous regions and municipalities), as well as the provincial capitals, cities with separate plans and some urban transportation departments with heavier reform tasks, to comprehensively interpret the two documents and supporting systems, and focus on explaining key issues. On this basis, the transportation departments of the provinces (autonomous regions and municipalities) will conduct publicity and implementation training for the relevant comrades of the transportation departments of the cities (counties and districts) under their jurisdiction to ensure a comprehensive, accurate and in-depth understanding of the two documents.

Beijing Times reporter Sha Xueliang

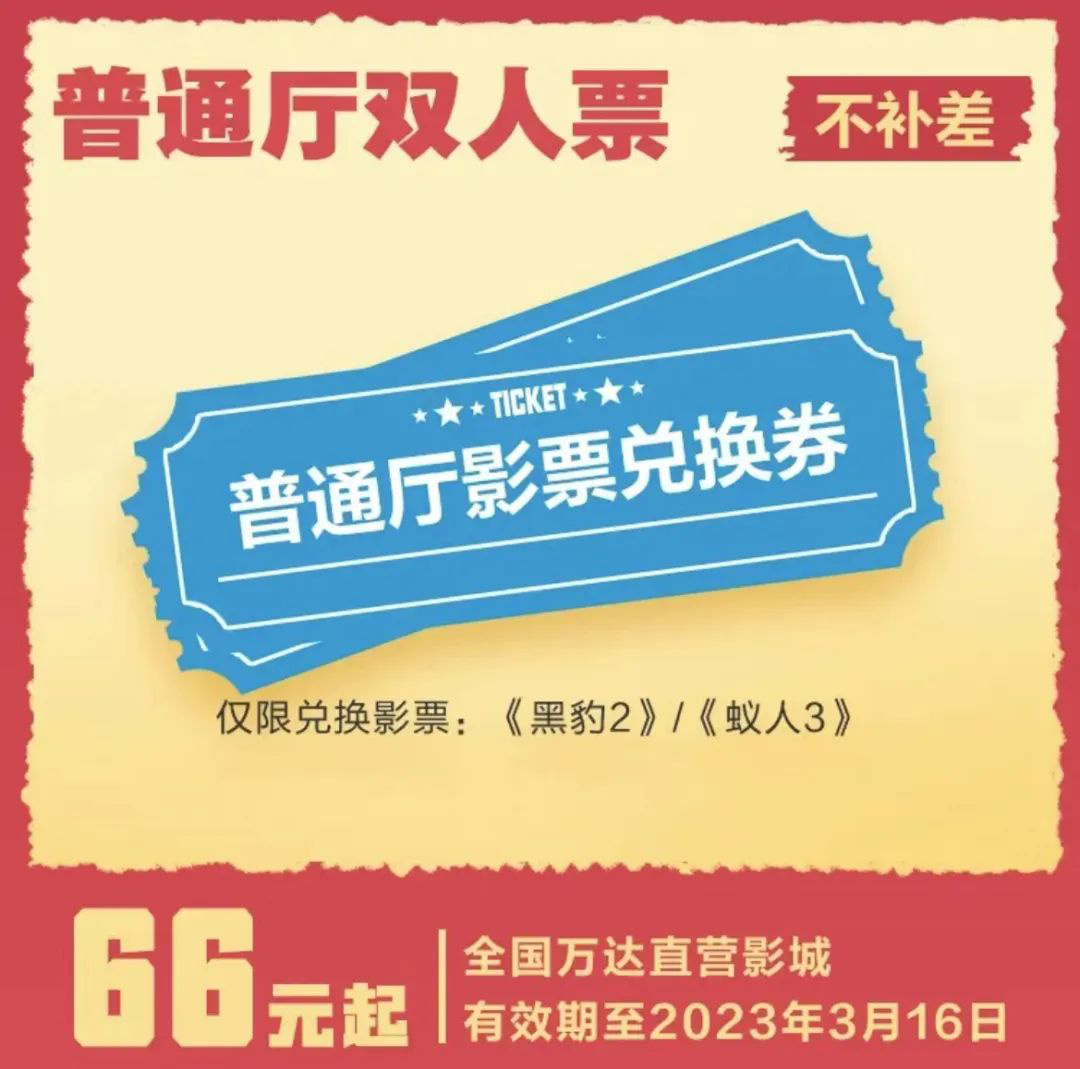

Image Source: Wanda Films

Image Source: Wanda Films