100,000 yuan China steel gun test drive Geely Binyue COOL.

Liuzhou eπ 008 price reduction news, the lowest price 178,600! Quantity is limited

[Autohome Liuzhou Discount Promotion Channel] Recently, we learned from Autohome Liuzhou Station that Changan New Energy is conducting preferential promotions in the Liuzhou market. The maximum discount amount has reached 28,000 yuan, and the minimum starting price is only 178,600 yuan. Interested consumers may wish to seize the opportunity and click the "Check the car price" button in the quotation form to get higher discounts.

eπ008采用流线型设计,车身线条简洁而富有力量感。前脸设计独特,配备有标志性的大尺寸进气格栅,格栅内部采用蜂窝状结构,增强了视觉冲击力。LED大灯造型锐利,与格栅融为一体,展现出未来感。整体风格偏向科技感和运动感,让eπ008在众多车型中脱颖而出。

eπ008的车身尺寸为5002*1972*1732mm,轴距为3025mm,前轮距和后轮距均为1650mm。车侧线条流畅,展现出动感的姿态,而配备的265/45 R21轮胎与时尚的轮圈设计相得益彰,增加了整车的运动感和豪华感。

eπ008的内饰风格采用现代简约设计,方向盘采用真皮材质,手感舒适且支持手动上下和前后调节。中控台配备了一块15.6英寸的触摸屏,集成了多媒体系统、导航、电话以及空调的语音识别控制系统,操作简便且功能丰富。前排配备了两个USB接口和两个Type-C接口,方便乘客为各种设备充电。同时,前排还配备了无线充电功能,让手机充电变得更加便捷。座椅采用仿皮材质,驾驶位座椅具有加热、通风、按摩和头枕扬声器功能,副驾驶座椅同样具备加热和通风功能,主副座椅均支持前后调节、靠背调节和高低调节,驾驶位还额外提供了腰部支撑调节功能,提升乘坐舒适度。第二排座椅具备靠背调节和腿托调节功能,乘客可以根据自己的需求进行调整,后排座椅还支持比例放倒,以满足不同的储物需求。

eπ008搭载了一台1.5T涡轮增压发动机,最大功率可达108kW(147马力),最大扭矩为210N·m,动力充沛。搭配电动车单速变速箱,进一步提升了驾驶体验和能效。

汽车之家车主对eπ008的整体设计给予了高度评价:“车身整体设计大气,非常耐看,看上去像30多万的车~”这样的评价不仅体现了eπ008在外观设计上的出色表现,也让人对其价值感有了更深的认识。

Cangzhou area eπ 008 special sale! The latest offer 188,600, discount waits for no one

[Autohome Cangzhou Discount Promotion Channel] Recently, a large promotion was ushered in in the Cangzhou market, with a maximum discount of 28,000 yuan. At present, the minimum starting price of this car series has been reduced to 188,600 yuan. If you are considering buying the eπ 008, you may wish to seize this opportunity and click the "Check Car Price" button in the quotation form to get a higher discount.

车系eπ008的外观设计采用了时尚且动感的风格,其前脸设计简洁大方,采用封闭式进气格栅,搭配锐利的LED大灯,呈现出强烈的科技感。车身线条流畅,侧面腰线贯穿前后,使整车看起来更加修长动感。整体而言,eπ008的外观设计既彰显了现代感,又不失稳重。

eπ008的车身尺寸为5002*1972*1732mm,轴距达到了3025mm。其车侧线条流畅而优雅,搭配了265/45 R21的轮胎规格,前后轮距均为1650mm,彰显出动感与稳定性。轮圈设计独特,增强了整车的视觉冲击力。

eπ008的内饰设计注重科技感与舒适性,中控台搭载一块15.6英寸的高清触控屏幕,集成了多媒体系统、导航、电话和空调等多种功能,并支持语音识别控制,为驾驶员提供便捷的操作体验。方向盘采用皮质材料,手感舒适,支持手动上下和前后调节。前排配备了两个USB接口和一个Type-C接口,后排则有三个Type-C接口,方便乘客充电。主副驾驶座椅均采用仿皮材质,支持多向调节,还具备加热、通风功能,驾驶位座椅更配置了头枕扬声器,为乘客带来舒适的乘坐体验。此外,前排和副驾驶位座椅均具备电动记忆功能,方便驾驶员和乘客轻松切换座椅设置。第二排座椅同样支持多向调节,腿部支撑可以灵活调整,满足不同乘客的需求。后排座椅可按比例放倒,增加后备厢的储物空间,进一步提升车辆的实用性。

eπ008搭载了一台1.5T L4发动机,最大功率为108kW,最大扭矩为210N·m。与之匹配的是一套电动车单速变速箱,为车辆提供了平稳且高效的驾驶体验。

汽车之家车主 表示,他们选择的向阳金颜色,接近银色,既时尚又耐看,而eπ008的外观设计更是大气十足。

The first batch of C this year

The appearance is off the charts! The official picture of the Blue Electric E5 PLUS is exposed, and the Aurora green body becomes the focus

At the intersection of technology and comfort, the blue electric car once again shocked the automotive market with its ingenious work – the blue electric E5 PLUS. This model is not only a profound insight into the needs of family travel, but also a brave exploration of future travel methods. With its unique charm, it heralds the arrival of a new realm of family travel.

The exterior design of the Blue Electric E5 PLUS is a perfect blend of technology and aesthetics. The body lines are smooth and full of tension, and every detail has been carefully carved to show a strong sense of the future. At the same time, its interior design is equally amazing, luxurious and warm, creating a private space full of comfort and technology for passengers.

In terms of spatial layout, the Blue Electric E5 PLUS shows its unique design concept. It provides a flexible seat configuration of "Big Five Seats, Enjoy Seven Seats". Whether it is a spacious five-seat layout or a practical seven-seat design, it can meet the diverse needs of different families for travel.

The Blue Electric E5 PLUS has achieved an effective space of 3162mm in the car, and the room acquisition rate has reached 66.4%, making it easier and more comfortable for the whole family to travel. The seven-seat model has more flexible space, and the maximum volume after the second and third rows are laid down can reach 1694L, which is more comfortable. The legroom in one row reaches 917mm, the legroom in the second row of the five-seat model reaches 885mm, and the second row of seats can be adjusted back to 119 °, bringing a comfortable and comfortable driving experience.

What is even more exciting is that the blue electric E5 PLUS is about to usher in the hot start of pre-sale. This model not only represents the latest achievements of blue electric vehicles in the field of new energy vehicles, but also pinned blue electric vehicles’ bright expectations for the future of the family travel market. With the approaching of pre-sale, more and more consumers have begun to pay attention to this model and have expressed strong interest in purchasing.

The dazzling debut of Blue Power E5 PLUS has not only injected new vitality into the family travel market, but also brought more high-quality, convenient and comfortable travel options to consumers. We firmly believe that in the days to come, Blue Power E5 PLUS will win more consumers’ favor and trust with its excellent performance and excellent quality. Let us look forward to the grand opening of the pre-sale of Blue Power E5 PLUS and witness the birth of this new realm of family travel together!

Tangshan area Asian dragon price news, the latest offer 150,800

Welcome to Autohome Tangshan Promotion Channel, we bring you exciting news! At present, the much-anticipated Toyota is conducting an unprecedented promotion in Tangshan area. The maximum discount range is as high as 33,000 yuan, bringing real benefits to car buyers. The starting price has been adjusted to 150,800 yuan, which provides consumers with excellent car purchase options. To seize this wave of price reduction opportunities, you may wish to click the "Check Car Price" button in the quotation form below to learn about and get better car purchase discounts in real time. Don’t miss it, act now!

[Introduction to the generated appearance]

As a mid-sized and large sedan that combines movement and elegance, the front face of the Asian Dragon is unique and eye-catching. It uses an integrated large-size air intake grille, which is enhanced by the use of chrome decorative strips. At the same time, the air intake grille is connected to the sharp headlights to form a smooth visual effect. The body lines are smooth, and the overall style is stable, giving a kind of aesthetic enjoyment that coexists with strength and tranquility. The side profile is slender, and the tail design is simple and delicate, showing the exquisite craftsmanship of the Asian Dragon in the details.

The side line design of the Asian Dragon is elegant and dynamic. The body length is 4990mm, width is 1850mm, height is 1450mm, and the wheelbase reaches 2870mm, which makes the body proportionally harmonious and shows the noble atmosphere of a luxury car. The front and rear wheel tracks are 1595mm and 1605mm respectively, which ensures good driving stability. The tire size is 215/55 R17, and it is matched with a delicate wheel design, which not only enhances the visual effect, but also provides a comfortable grip, making the overall appearance more modern and sporty.

The Asian Dragon’s interior design incorporates modern simplicity and business comfort, with attention to detail and texture improvement. The steering wheel is made of lightweight plastic material, but pays attention to the grip and control feeling. It is equipped with manual up and down + front and rear adjustment functions to ensure the comfort and convenience of the driver. The center console is equipped with a 10.25-inch large-size touch screen. The operation interface is intuitive, the display information is rich, and the interaction with the driver is strong. The seat is made of fabric material, which has been carefully designed to provide good support and comfort. The main and passenger seats support multi-directional adjustment, including front and rear, backrest and high and low adjustment, to meet the needs of different passengers. In addition, the car is also equipped with a Type-C interface, which is convenient for passengers to connect and charge multimedia. There are multiple USB ports in the front and rear rows to meet the daily needs of passengers.

The engine of the Asian Dragon is equipped with a 2.0L displacement L4 engine with a maximum power of 127 kW and a maximum torque of 206 Nm. This powertrain is matched with a CVT continuously variable transmission (analog 10th gear), providing a smooth driving experience and good fuel economy.

All in all, Autohome owners are full of praise for the exterior design of the Asian Dragon, believing that the choice of white and silver is particularly brilliant, which not only gives the owner a unique temperament, but also shows an atmospheric and exquisite business style. The owner believes that whether it is the wide design of the front of the car or the slender lines on the side, it adds calmness and dynamism to the Asian Dragon, making it unique in appearance, which is fully in line with his pursuit of a successful person’s image. This evaluation undoubtedly adds more charm to the Asian Dragon, making car buyers more determined when choosing.

Subaru, Lincoln, Volvo 45,000 have been recalled.

China Economic Network Beijing, August 15th (reporter, Liu Peng) Recently, the State Regulation for Market Regulation issued three recall announcements, including Subaru’s partial import of Aohu, Lion, XV series cars, Ford’s partial import of Lincoln Navigator cars, Volvo’s partial import of FH tractors, a total of 45,388 vehicles.

Subaru Automotive (China) Co., Ltd. is recalling some imported Aohu, Lishi, and XV series vehicles

Since October 10, 2022, some imported Aohu, Lishi, and XV series vehicles have been recalled, totaling 42,551 vehicles. The specific recalled models are as follows:

From October 3, 2014 to September 14, 2017, some imported 2015-2017 Aohu series cars totaled 33,564 vehicles; from September 11, 2015 to September 8, 2017, some imported 2016-2017 Lion series cars totaled 3,177 vehicles; from August 9, 2017 to August 10, 2018, some imported 2018 XV series cars totaled 5,810 vehicles.

It is reported that some vehicles within the scope of this recall are prone to moisture absorption due to the material of the wiring harness joints of the electronic parking brake adapter. The joints may be cracked and loose due to the corrosion of snow melting agents, resulting in the lighting of the brake alarm light and the failure of the electronic parking brake to start or release, which poses a safety hazard.

Subaru Automotive (China) Co., Ltd. will inspect the electronic parking brake adapter wiring harness connector for vehicles within the scope of the recall, and if the recalled parts are installed, additional fixed clamps will be installed free of charge to eliminate safety hazards.

Emergency response method: When the electronic parking brake cannot be activated or released, the user can keep the vehicle stopped by hanging the P gear, and contact the nearest authorized dealer to inspect and deal with the vehicle.

Ford Motor (China) Co., Ltd. is recalling some imported Lincoln Navigator vehicles

From October 12, 2022, a total of 2,833 imported 2021 Lincoln Navigator vehicles manufactured between November 18, 2020 and August 31, 2021 will be recalled.

It is understood that some vehicles within the scope of this recall are not fully covered by the printed circuit board vias in the battery junction box, which may cause corrosion of the circuit board under the action of pollutants and water, resulting in short circuit overheating and fire risk.

Ford Motor (China) Co., Ltd. will commission Lincoln brand authorized dealers to inspect the battery junction box for signs of melting free of charge for vehicles within the scope of the recall, replace the battery junction box free of charge if any, and install a relay box with jumpers to eliminate safety hazards.

Emergency response measures: Until the recall repair is completed, the affected vehicle should be parked in an open area without other vehicles. If the above conditions are not met, the user should contact the dealer, who can arrange on-site service to help disconnect the vehicle’s negative battery cable and secure it.

Volvo (China) Investment Co., Ltd. recalls some imported FH tractors

From now on, some imported 2021 Volvo FH tractors produced between May 5, 2021 and May 18, 2021 will be recalled, totaling four vehicles.

It is reported that some vehicles within the scope of this recall are not properly installed due to the exhaust gas collector clamp between the engine turbocharger and the composite turbine, resulting in high-temperature exhaust gas leakage during engine operation, causing the right steering wheel parking brake pipe to overheat. In extreme cases, the parking brake pipe will leak due to overheating, and the right steering wheel parking brake may be abnormally applied when the vehicle is running, resulting in accidents and potential safety hazards. At the same time, the leaked high-temperature exhaust gas is directly discharged into the atmosphere, which also poses emission hazards.

Volvo (China) Investment Co., Ltd. will conduct a free exhaust leak inspection of the compound turbine area of the recalled vehicles through authorized dealers. If there is an exhaust leak, the corresponding parts will be replaced according to the location of the leak; and the vehicle will be equipped with a parking brake line protective cover to eliminate safety hazards and unreasonable emissions.

Smart R7 price 229,800, Huawei Smart Drive, 802km battery life

[Understanding the Way of Cars, Products] Recently, Understanding the Way of Cars learned that the new coupe SUV under Hongmeng Zhixing was officially released.The official price range is 259,800 – 339,800 yuanIntelligent World R7 is jointly built by and

It is reported that the Smart R7 Max/Ultra version will start mass delivery on October 15, and the Smart R7 Pro version will start mass delivery on November 15. Let’s take a look at the product strength of the new car.

Externally, the Smart R7 uses a similar family-style design language, using the "Inside-Out" interior and exterior design language, the front face adopts a closed grille, equipped with a through light strip, and the top of the light strip is equipped with a headlight group. The headlight is equipped with far and near headlights and an ultra-wide-angle lighting system. The front of the car is equipped with an active air intake grille (AGS) to reduce wind resistance. The front compartment is also configured.

In terms of appearance colors, there are 6 kinds available, specifically ceramic white, deep space gray, gilt black, metropolitan red, purple, and clear blue.The roof is equipped with a binocular camera integrated inside the front windshield, and the front fender position is also designed with a camera. Equipped with ADS 3.0 end-to-end humanoid intelligent driving system.

Coming to the side of the body, it adopts the coupe SUV design style, starting from the B-pillar and sliding gently, showing a slip-back shape. This design not only meets the styling design but also takes into account the practicality of the spacious space in the car. The shoulder line creates a wide-body shape and is also equipped with door side trims.

Standard 20-inch double five-spoke rims, optional 21-inch double ten-spoke rims, tires are P-Zero series, and the interior is also equipped with red brake calipers, which are full of sportiness. In terms of body size, the car’s length, width and height are 4956/1981/1634mm, and the wheelbase is 2950mm.

The rear of the car body, the raised tail shape, the overall emphasis is more round and full, using a through-type tail light group, the internal light source arrangement has a strong sense of technology, equipped with a fixed small size rear spoiler, hatchback tailgate design, and the bottom is also equipped with a diffuser.

In terms of interior, it adopts a yacht-style encircling cockpit design, which shows a simple style as a whole. The three-frame shape is chic. The design concept of the center console comes from the front deck of the yacht. In terms of intelligence, the far end is arranged in the form of a 12.3-inch full LCD instrument panel and a 15.6-inch floating central control screen. The lower side of the central control screen is equipped with a wireless charging panel for mobile phones.

Equipped with electric sunshades, rear privacy glass, co-pilot zero-gravity seats and other configurations. There is a rear entertainment screen on the back of the front seats, and the rear entertainment screen uses Huawei Maglink interface to connect with the front seats.

In terms of power, single-motor version and dual-motor version models are provided, of which the maximum power of the rear motor of the single-motor version model is provided.for215kW; the maximum power of the front motor of the dual-motor version is 150kW, and the maximum power of the rear motor is 215.kWAvailable in capacities of 82kWh and 100kWhThe CLTC pure electric cruising range provides 667km, 736km, and 802 km.

In terms of chassis, based on the development of Tuling chassis platform, the suspension combination of front virtual kingpin double fork arm + rear five links is adopted, and the whole system is equipped with CDC variable damping shock absorber and intelligent road condition recognition system as standard.

The editor has something to say:

Zhijie R7 is the second model jointly created by Huawei and Chery. The new car is positioned as a pure electric medium-sized SUV. In terms of competing products, it will compete with, EC6,,,, etc. As a car model under Hongmeng Zhixing, it is also a coupe type, rich in hardware configuration and comfort configuration. The full 800V architecture, standard CDC suspension system, and high-end intelligent driving system. If you want to know more about new cars and car buying conditions, please leave a message to interact. Everyone must consume rationally when buying a car. (Photo/text/photo: Understanding the way of cars, Chen Fengmei, editor)

Shenyang Asian Dragon price news! The latest offer 153,800, only this time

Welcome to Autohome Shenyang Promotion Channel, we bring you the latest car news. At present, the much-anticipated Toyota is conducting preferential promotions at attractive prices in Shenyang. It is revealed that the maximum discount has reached an astonishing 40,000 yuan, which makes the original starting price of 153,800 Asian Dragon more cost-effective. For consumers who are interested in buying, this is undoubtedly a good opportunity not to be missed. Want to seize this opportunity and enjoy lower car purchase costs? Be sure to click "Check Car Price" in the quotation form, and let our professional consultants provide you with the latest and most accurate preferential information to help you realize your car purchase dream.

The exterior design of the Asian Dragon shows the perfect blend of elegance and power. The front face features a bold air intake grille, which is wide and unique, and with sharp LED headlights, it creates a strong visual impact. The body lines are smooth and the overall style is stable, giving a feeling of high-end business cars, showing its unique position in the same class of models.

The side-body design is the unique charm of the Asian Dragon. The body length reaches 4990mm, the width is 1850mm, the height is 1450mm, and the wheelbase is 2870mm, providing a spacious interior space for passengers. Its front and rear wheel tracks are 1595mm and 1605mm respectively, ensuring excellent driving stability. In terms of tire specifications, the Asian Dragon adopts the consistent 215/55 R17 specification, with dynamic wheel design, which not only enhances the visual effect of the vehicle, but also ensures good grip performance, and is more stable during driving. Overall, the side lines of the Asian Dragon are smooth and atmospheric, highlighting its unique design aesthetics and practicality.

The interior design of the Asian Dragon highlights the style of luxury and comfort, characterized by exquisite craftsmanship and user-friendly layout. The steering wheel is made of plastic with good texture, providing manual up and down + front and rear adjustment functions, ensuring that the driver can adjust the best grip angle according to needs. 10.25-inch central control screen, the interface is intuitive and rich in functions, which is convenient for users to control various functions and entertainment systems of the vehicle. The seat part is made of fabric material. Although it is not the top luxury, it pays attention to durability and comfort. The main and auxiliary seats support multi-directional adjustment, including front and rear, backrest and high and low adjustment, to meet the needs of different passengers. The overall interior design focuses on practicality and texture, creating a pleasant interior space for passengers.

For the Asian Dragon series, the 2.0L engine on board can achieve a maximum power output of 127 kilowatts, while providing 206 Nm of peak torque. This powertrain uses an L4 layout, which can provide stable performance for the vehicle. With the CVT continuously variable transmission (analog 10th gear), the Asian Dragon has good performance in terms of shift smoothness and fuel economy.

In general, Autohome owners are full of praise for the exterior design of the Asian Dragon, especially the dot matrix design of China Net and the blue Toyota logo. These details undoubtedly give the vehicle a unique and fashionable temperament. He said that this design style just caters to his aesthetic, making the Asian Dragon not only a car in his eyes, but also a manifestation of life attitude. The owner’s recognition of the Asian Dragon undoubtedly provides confidence to consumers who pursue design sense and quality, which is also one of the key factors for the Asian Dragon to stand out among many models and win the favor of consumers.

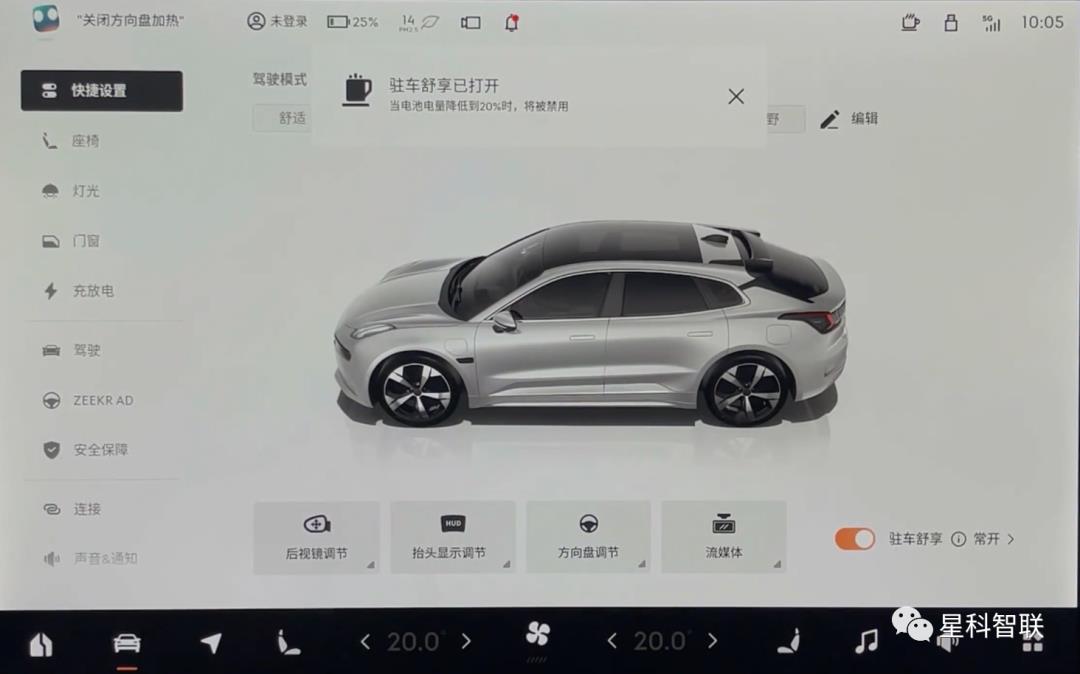

Scene Mode Feature | Camping Mode

Do you also want to go out for a stroll and drive around in your spare time? The following article is about how this camping mode can come in handy when driving out to camp. Let’s take a look at more content to learn!

Camping mode, also known as "camping space"/"parking comfort"/"camping mode".

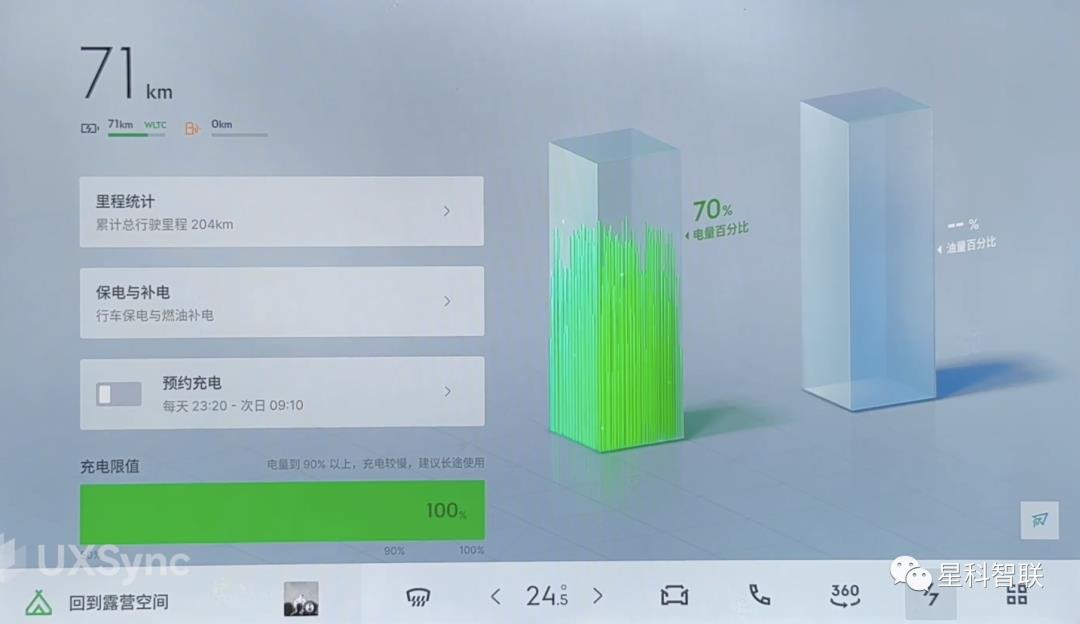

It means that after the function is turned on, the vehicle air conditioning system can continue to work, and the battery can continue to supply external power to provide the power required for camping. Generally, there is a maximum discharge limit to prevent the battery from over-discharging.

On the Model Y’s air-conditioning interface, clicking "Camping" will display the following instructions: The vehicle will remain powered on until the battery drops to 20%, and Sentinel mode, security alerts, and exit locks will be disabled.

After the mode starts, the screen will remain normally on, and the air conditioner will switch to automatic mode, but the user can still operate the air conditioner settings freely. Even if the automatic mode is exited, it will not exit the camping mode in combination. The exit method of this mode can only be manually turned off or automatically exited after the battery is lower than 20%.

After clicking "Camping Space", a second prompt appeared in the system pop-up window: Under the camping space, the vehicle will remain powered on until the vehicle battery is lower than 20%.

Attention: If the vehicle battery is lower than 20% and is not charging, or if there is an abnormality in the vehicle’s high voltage system, it will automatically exit the camping space and open the window to ventilation mode.

After officially entering the mode, the system will enter the exclusive homepage of camping mode, which adds functions and applications commonly used by users in camping scenarios:

You can set the screen to turn off in the upper right corner of the main interface of the mode:

Click "Discharge":

Exit "camping mode" is also similar to Tesla, that is, manually turn off or automatically exit after the battery drops below 20%.

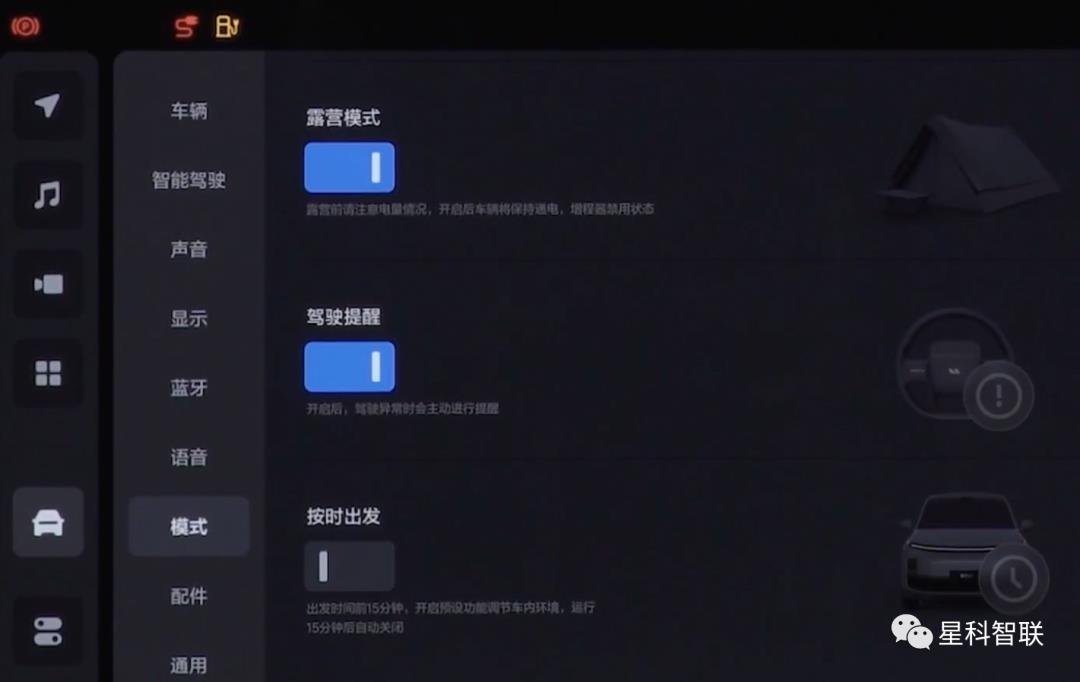

In the settings, there is an introduction below the "Camping Mode" button: Please pay attention to the power condition before camping. After turning it on, the vehicle will remain powered on, and the range extender will be disabled.

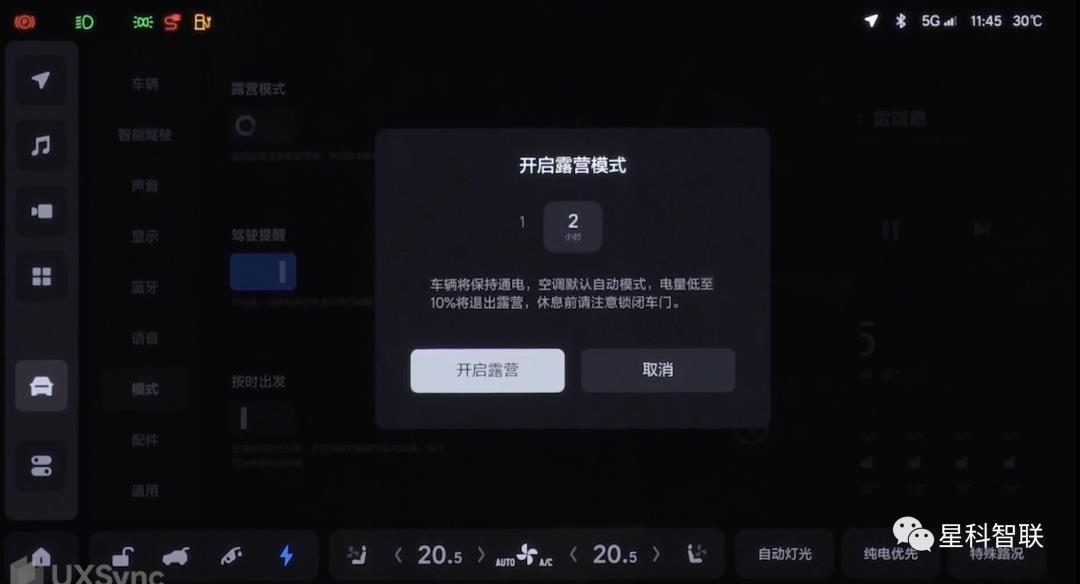

The system pop-up window shows a secondary prompt: the vehicle will remain powered on, the air conditioner will default to automatic mode, and the battery will be low to 10% to exit camping.

Please lock the door before the break.

The above mode duration gives the user up to 2 hours of activation time.

After the user clicks "Start Camping", the screen of the whole car goes black directly, and it needs to be clicked multiple times to restore the screen to light up.

After the screen lights up, go directly back to the main page of the system.

At this time, if you need to manually exit the camping mode, the user needs to click "Settings" → "Mode" → "Camping Mode" again to turn off the camping mode.

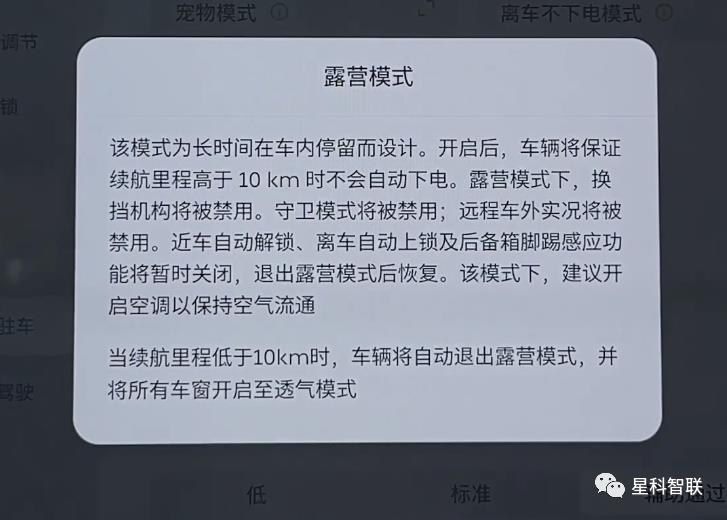

Click the introduction button under "Camping Mode":

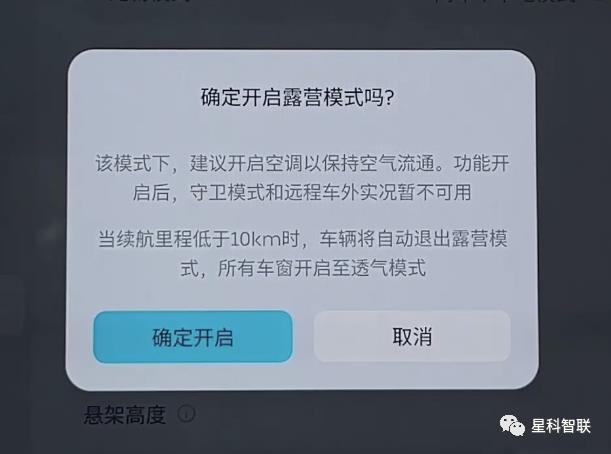

After clicking Start "Camping Mode", the second prompt pop-up window:

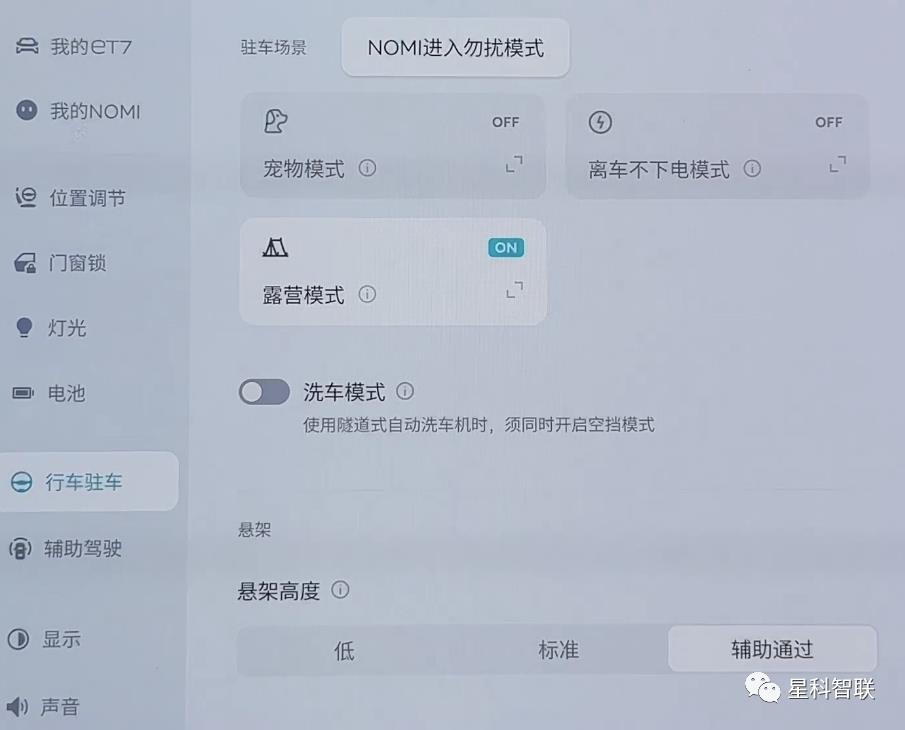

After officially starting the mode, it prompts "NOMI to enter Do Not Disturb Mode", and "ON" is displayed in the upper right corner of the mode. The screen remains always on and can operate all the functions of the system normally. However, in addition to manually exiting the mode, unlike other cars, ET7 uses the remaining battery life to inform the user when the mode automatically exits.

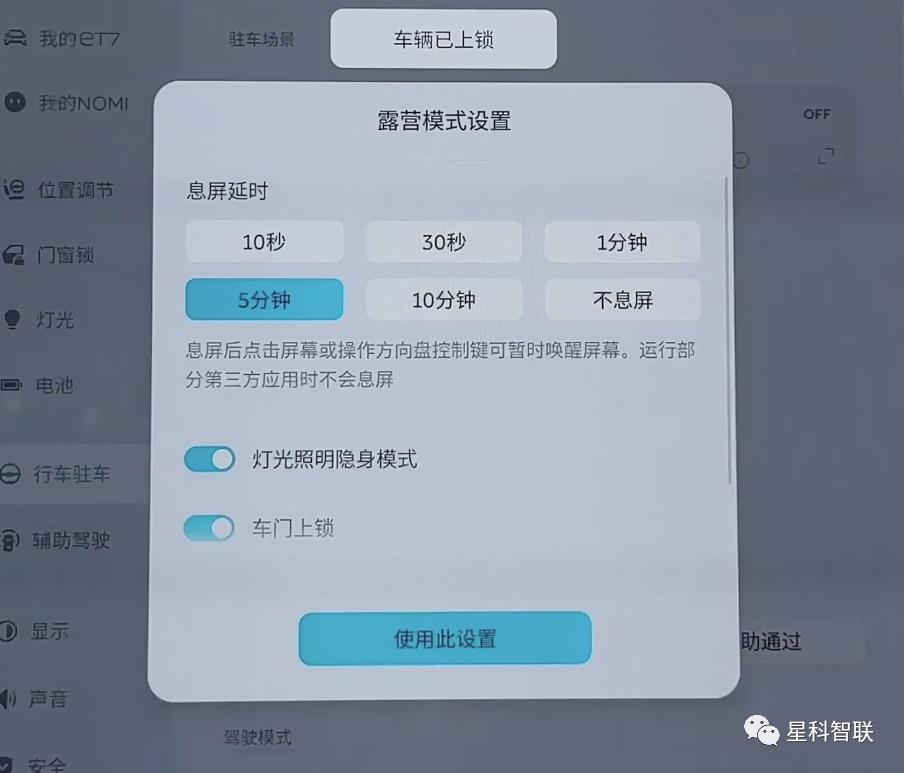

In addition to this, multiple settings after the start of custom camping mode are also supported:

- Off screen delay setting

- Lighting Stealth Mode

- Doors are locked

- Close the windows

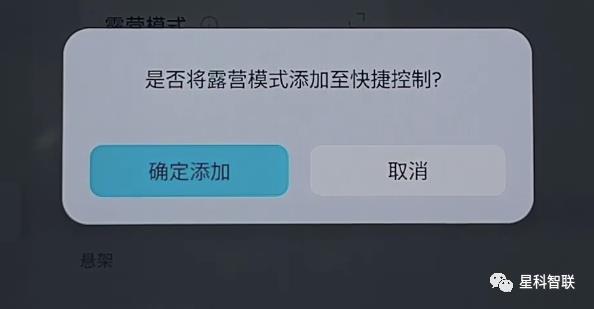

You can also set whether to add "Camping Mode" to the drop-down menu bar for quick opening.

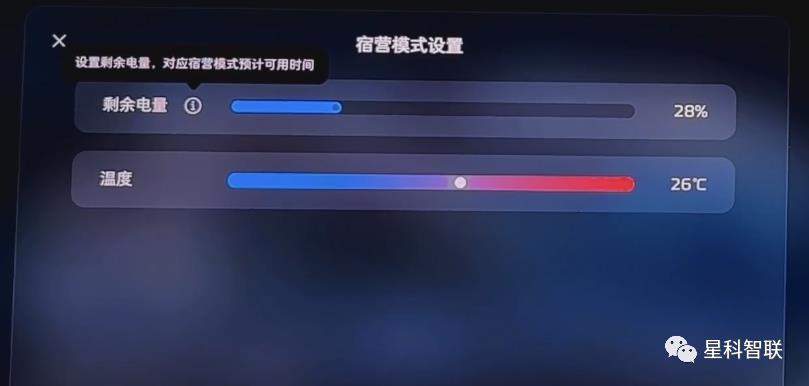

Click "Camping Mode" to directly enter the mode page. On the page, you can see the time when the remaining power is available to turn on the mode:

Unlike other cars, F7’s "camping mode" allows users to customize the minimum remaining battery value:

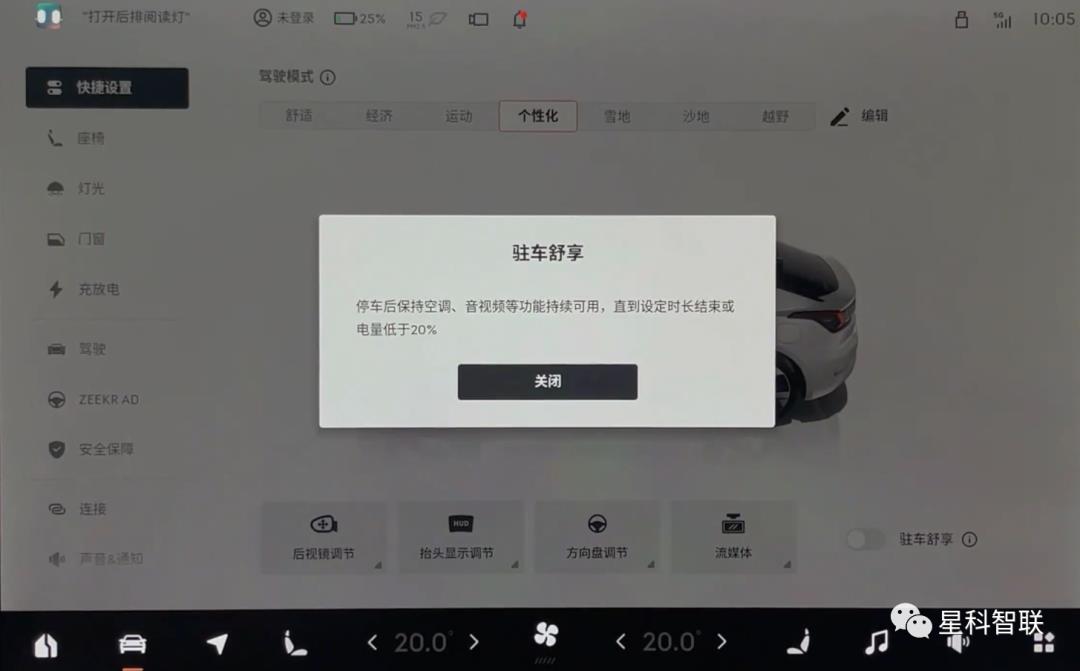

Click the mode introduction button of "Parking Comfort": Keep the air conditioning, audio & video and other functions available after parking until the set time ends or the battery is lower than 20%.

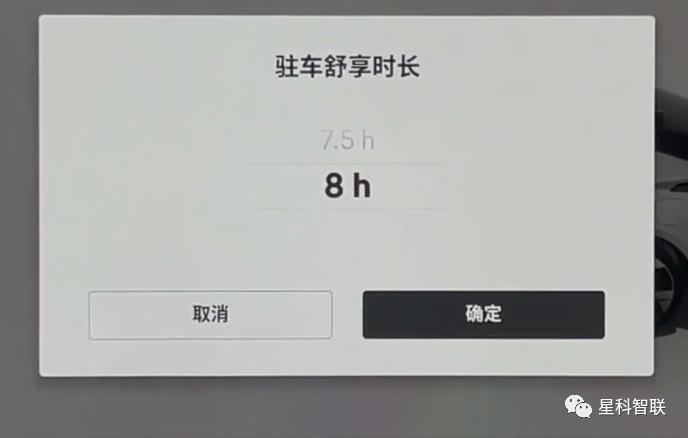

The custom duration of the mode is at least 0.5 hours, and it can be set for up to 8 hours or "normally open":

There is a status prompt after the mode is turned on, and the mode supports manual or automatic exit.

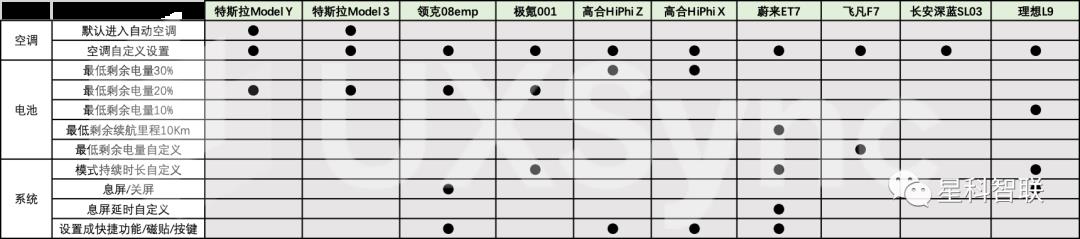

The following are all models equipped with "camping mode" on the Xingke Zhilian platform, and the product details are recorded in the execution of the mode:

We observed that:

- The prerequisite for all models to turn on "camping mode" must be that the vehicle is in the parked gear (P gear) state, and the vehicle cannot switch gears after the mode starts.

- Due to the greater demand for electric energy in electric vehicles, the minimum remaining power requirements of electric vehicles are higher than those of extended-range/plug-in models.

- Considering the camping scene, the user’s environment is changeable, and the user request is also full of variables. Therefore, after the "camping mode" is turned on, giving the user more setting options will not only make it more convenient for the user’s various environmental needs, but also help the vehicle save electricity and fuel. For example, after the Lynk & Co 08 turns on the camping mode, the user can quickly operate the discharge, or quickly open Karaoke, a film and television entertainment application. At the same time, the Lynk & Co 08 and NIO ET7 are also the only models that can operate the off-screen in the mode, giving the user the option to turn off the screen and save power.