Xinhua News Agency Beijing August 2 New Media Special Telegram Question: Whether the merger of Didi and Uber is a monopoly needs to pass "two thresholds"

Xinhua News Agency "China Network" reporters Yang Yishen and Ding Jing

Shen Danyang, a spokesperson for the Ministry of Commerce, said on August 2 that he had not received a declaration on the concentration of operators of Didi and Uber China-related transactions. This statement continues to raise great concerns about the potential monopoly problems caused by the merger of Didi and Uber.

Industry experts say that even if Didi and Uber China do not declare the merger, they may still face active review by regulatory authorities before the merger. And even if the merger goes smoothly, if there is a monopolistic behavior later, they will also face regulatory enforcement. A major problem currently facing all parties is the embarrassment caused by data statistics and judgment standards in the supervision of new business models.

Threshold 1: If you don’t declare yourself, you won’t be able to evade antitrust scrutiny

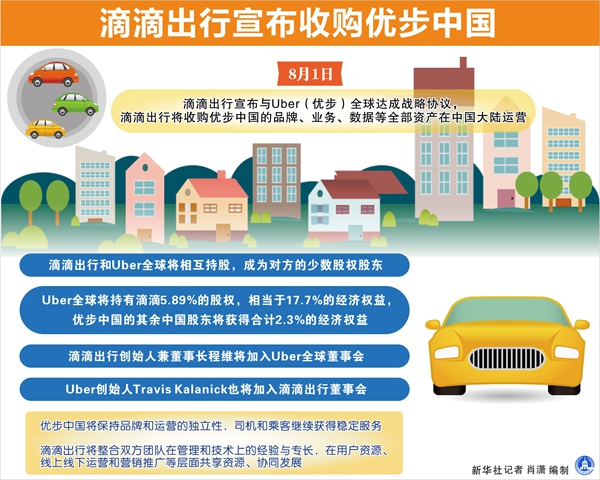

On August 1, Didi Chuxing announced that it would merge with Uber China, mainly through the acquisition of Uber China’s brand, business, data and other assets by Didi. After the deal is reached, Didi Chuxing and Uber Global will hold shares in each other and become minority shareholders of each other.

Giants must pass an anti-monopoly review if they want to merge. However, at a press conference on August 2, Shen Danyang said: "The Ministry of Commerce has not yet received the declaration of concentration of undertakings related to Didi and Uber China. According to regulations, all operators who meet the declaration conditions stipulated in the Antimonopoly Act and the declaration standards stipulated in the" Regulations of the State Council on the Declaration Standards of Concentration of Operators "should report to the Ministry of Commerce in advance. If they do not declare, they cannot implement concentration."

According to Didi’s statement: "At present, neither Didi nor Uber China has achieved profitability, and Uber China’s turnover in the last fiscal year did not meet the reporting standards. Therefore, in accordance with the Antimonopoly Act and the" Regulations of the State Council on the Reporting Standards of Concentration of Underwriters ", it is not necessary to report to the relevant departments in advance. We will also maintain active and smooth communication with the relevant departments."

In this regard, Su Hua, an associate researcher at the American Institute of the Chinese Academy of Social Sciences, who has participated in many anti-monopoly investigations, told reporters that according to China’s "Antimonopoly Act" and the declaration standards for concentration of undertakings, in terms of procedures, merger transactions need to be submitted to the Anti-Monopoly Bureau of the Ministry of Commerce for review, or the Anti-Monopoly Bureau may initiate an investigation on its own initiative.

Many industry experts said that whether companies declare themselves is on the one hand, and on the other hand, it is also important for regulators to take the initiative in advance.

"Mergers and acquisitions that have substantial evidence that will lead to significant restrictions and exclude competitive effects may be prohibited," Mr. Su said. "The significance of the Antimonopoly Act censorship is that the entity assesses whether the transaction is likely to lead to monopolistic behavior, and can make a pre-judgment and evaluation."

Threshold 2: If there is a monopoly, it can be supervised at any time during and after the event

The reporter learned that although the previous merger of Didi Kuaidi did not independently declare for anti-monopoly review, if there is a monopolistic behavior after the successful merger of Didi and Uber, it will also face regulatory enforcement.

Although the overall industry price of online car-hailing has not changed much in the short term, issues such as "whether subsidies will be reduced", "whether red envelopes will be cancelled" and "whether prices will be increased" are still the most concerned issues for ordinary consumers. Many experts believe that even if Didi and Uber successfully merge, they will still face great regulatory pressure and public opinion pressure.

Cheng Shidong, director of the Urban Transportation Office of the Comprehensive Transportation Research Institute of the National Development and Reform Commission, said that industry supervision needs to focus on identifying the business practices of market players in a dominant position and preventing market behaviors of unfair competition.

In this regard, industry insiders combined with a series of previous anti-monopoly cases to analyze the monopolistic behavior that may occur if Didi and Uber merge: "The post-merger entity (Didi + Uber) implements restrictions on competition, which may include but are not limited to fixing prices, restricting supply, dividing the market, refusing to trade, ultra-high pricing, predatory pricing, discriminatory pricing, bundling and tying, etc."

For monopolistic behavior that consumers are concerned about, there will still be supervision in the interim and post-event stages. In this regard, Su Hua said that the difference between the Antimonopoly Act, which is in charge of the Anti-Monopoly Bureau of the Ministry of Commerce, and the prohibition of monopoly agreements and the prohibition of abuse of dominance (the Price Supervision Bureau of the National Development and Reform Commission and the Competition Enforcement Bureau of the State Administration for Industry and Commerce), is that the former is a pre-evaluation and judgment of transactions, and the latter is a post-evaluation and judgment of behavior.

The lack of new business judgment standards has caused regulatory embarrassment

The above two thresholds are both difficult problems that Didi and Uber need to face before and after the merger. In this regard, industry insiders believe that from the observation of the governance concept of strengthening in-process and ex-post supervision, the anti-monopoly review of concentration of undertakings in the new economy has more variables and greater difficulty. One of the important factors is that there are still differences in the judgment standards and data statistics of the new business model of online car-hailing.

According to a set of data released by Didi’s official website this year, many people may think that the monopoly position after the merger is very obvious:

"Didi Hitch is a mutual-assistance C2C ride-sharing platform owned by Didi Chuxing. According to a report by Trustdata, a third-party research organization, Didi Hitch accounts for 76.8% of the ride-sharing market."

"According to CNNIC data, Didi Chuxing has occupied 87.2% of the market share in China’s private car industry. Data from several authoritative research institutions also show that Didi Chuxing is also in a market leadership position in verticals such as hitchhiking, chauffeur driving, and test driving."

Of course, the actual situation is not only that the number can prove the monopoly, but also the attitude of competitors in the industry is worth referring to. Regarding the merger of Didi and Uber, Shouqi Car-hailing and others do not think it will form a monopoly. Wei Dong, CEO of Shouqi Car-hailing, believes: "Because of the existence of platforms such as Shouqi Car-hailing and Shenzhou Car-hailing, they also have traffic advantages, and it is difficult to achieve monopoly [of Didi and Uber merger]."

Cheng Shidong believes that online car-hailing has not yet been fully integrated with industry supervision, and there is no authoritative and accurate data on the statistics. "More supervision should be carried out from the perspective of monopoly, rather than the supervision of daily market competition behavior."

"To give a simple example, how much is the price of online car-hailing reasonable?" One industry insider said that this kind of question illustrates the current difficulty in judging how the online car-hailing industry can be regarded as a monopoly.

关于作者